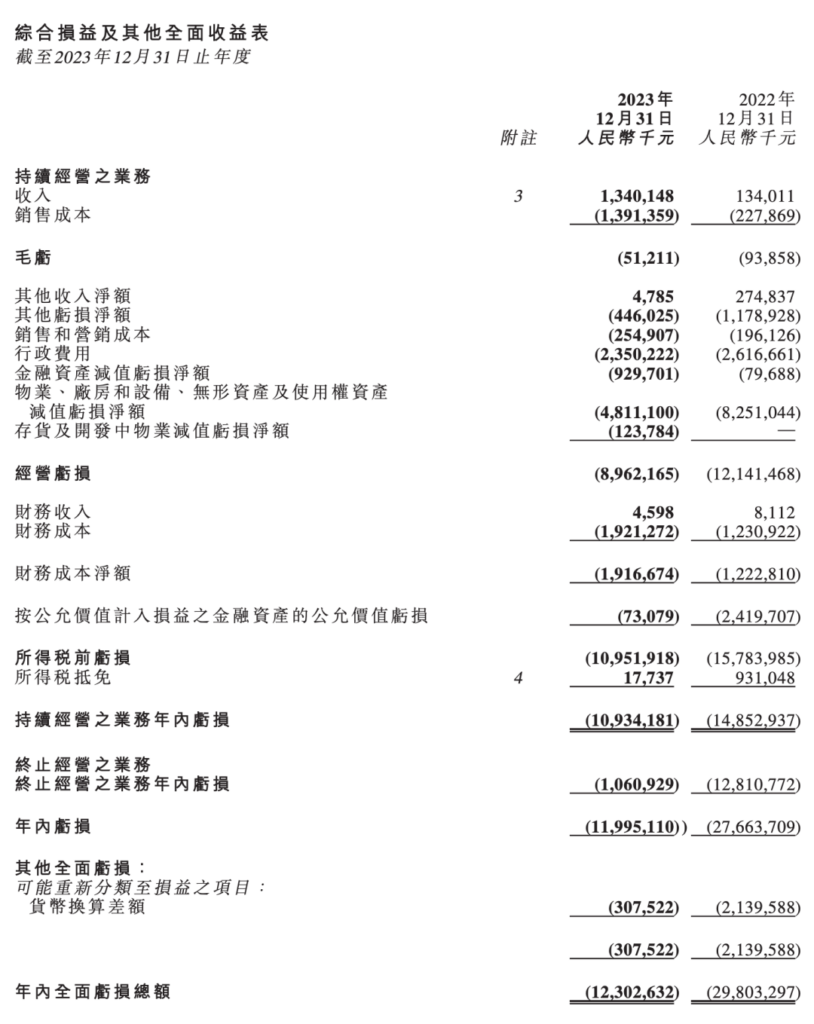

March 27, Evergrande Auto released its 2023 financial report. During the reporting period, Evergrande Auto’s revenue was 13.40 billion yuan, a year-on-year increase of 900.03%; the shareholder’s attributable loss was 11.995 billion yuan, a year-on-year reduction of 56.64%, of which the loss from discontinued operations (i.e. divesting real estate projects) was 1.061 billion yuan, and non-operational losses such as asset disposal and asset impairment were 6.384 billion yuan, and operating losses were 4.550 billion yuan. As of December 31, 2023, Evergrande Auto’s total assets were 34.851 billion yuan, and its total liabilities were 72.543 billion yuan, including 26.484 billion yuan in borrowings, 43.012 billion yuan in trade and other payables, and 3.047 billion yuan in other liabilities. In other words, Evergrande Auto is already insolvent. As of December 31, 2023, Evergrande Auto’s cash and cash equivalents were 129 million yuan, and the cash flow forecast can still be maintained for at least 12 months. It is worth mentioning that in the case of Evergrande Auto’s consecutive huge losses, Chairman Sean and Vice Chairman Liu Yongzhuo received huge salaries. The combined salaries in 2021 and 2022 both exceeded 100 million yuan.

Evergrande Auto stated that due to the influence of external and internal factors, production and sales did not meet expectations, and the company faced operational difficulties. The R&D, production, and sales activities, as well as the stability of the employee team, were affected. As of December 31, 2023, the Tianjin manufacturing base produced Hengchi 5 according to market demand, with a cumulative production of 1,700 units and a cumulative delivery of more than 1,389 units. Recently, due to funding issues, the group has arranged for the leave of some personnel, and the Tianjin factory has suspended production.

Evergrande Auto stated in its financial report that the group will make every effort to introduce strategic investors and actively raise funds to sustain the group’s survival and future development plans. On January 1, 2024, Evergrande Auto issued an announcement stating that the share subscription agreement and the debt-to-equity subscription agreement with Newton Group were originally scheduled to expire on December 31, 2023, but have now expired. However, Evergrande Auto also emphasized in the announcement that despite the expiration of the agreement, Evergrande Auto, Newton Group, and other relevant parties are still negotiating the key terms of these transactions, indicating that a new agreement or amendment to the original agreement may still be reached. It is understood that Newton Group is an electric vehicle company located in Dubai, UAE. It was formerly a company in Tianjin, China, AiConic. Its founder, Wu Nan, also comes from China. In 2016, he established Tianjin Tianqi Group Co., Ltd., with the controlling shareholder being AiConic (Tianjin) Investment Co., Ltd. In 2018, AiConic’s new energy vehicles were located in Zhaoqing, Guangdong. In 2019, it showcased seven concept vehicles at the Shanghai Auto Show, and in the same year, it spent nearly 870 million yuan to acquire Tianqi Meiya to obtain vehicle manufacturing qualifications. According to AiConic’s earlier plan, its first product, the AiConic 7, will be launched in 2019, and two new cars built on the same platform as the AiConic 7 will be launched in 2021 and 2022 respectively. However, due to the pandemic and financing issues, there have been few news about the brand since 2019.

In addition, the president and executive director of Evergrande Auto, Liu Yongzhuo, has been arrested. On January 8, Evergrande Auto issued an announcement stating that executive director Liu Yongzhuo was suspected of violating the law and has been criminally detained in accordance with the law. According to the information, Liu Yongzhuo has been serving Evergrande Group since 2003 and was in charge of businesses such as Guangzhou Evergrande Taobao Football Club, Evergrande Cultural Industry Group, Evergrande Agroforestry Group, Evergrande Internet Finance Group, and Evergrande High-Tech Group. He currently serves as the executive vice president of Evergrande Group, the president of Evergrande Auto, the chairman of Evergrande New Energy Technology Group, and the dean of the Vehicle Research Institute.

As the main person in charge of Evergrande Auto, Liu Yongzhuo once said publicly, “The great sale of Hengchi has become a foregone conclusion.” However, from the data point of view, the performance of Hengchi 5, the first mass-produced model of Evergrande Auto, is not satisfactory. The terminal sales data shows that Evergrande has sold a total of 980 vehicles in 2023.

Currently, the competition in the new energy vehicle industry is extremely fierce. Many multinational joint venture brands are struggling, not to mention the cross-border car manufacturing companies of debt-ridden real estate companies. Returning to the product itself, Hengchi 5 is positioned as a compact pure electric SUV, which is not expensive compared to models of the same level, and the product configuration is not bad. However, Hengchi Auto has not formed its own advantages. The power, range, and auxiliary driving of Hengchi 5 are only mediocre, and it is difficult to show sufficient competitiveness compared with brand products such as BYD and Tesla. The most crucial point is that Evergrande is heavily in debt, Evergrande Auto is insolvent, and how Hengchi can convince consumers to buy products from such a company is another major challenge.