April 5th, Evergrande Auto issued an announcement stating that the strategic investment of Newtown Group has been terminated, and the revision of the terms of the previously proposed transaction and debt-to-equity swap has not made any further progress. In short, Evergrande Auto has lost its “funding source”, and the investment of 500 million US dollars (approximately equivalent to 3.55 billion yuan) has ended with “failed”.

The transaction between Evergrande Auto and Newtown Group has been terminated, which may have already had omens beforehand. In fact, on January 1st this year, Evergrande Auto issued an announcement that the share subscription agreement between Evergrande Auto and Newtown Group, as well as the debt-to-equity swap subscription agreement, were originally scheduled to expire on December 31st, 2023, and have now become invalid. At that time, Evergrande Auto stated that despite the agreement having become invalid, Evergrande Auto, Newtown Group, and other related parties are still negotiating the key terms of these transactions, indicating that the two sides still may reach a new agreement or modify the original agreement. Before that in October 2023, Evergrande Auto also issued an announcement stating that Newtown Group has suspended the implementation of the relevant obligations in the share subscription agreement.

The transaction between Evergrande Auto and Newtown Group began on August 14th, 2023, when Evergrande Auto issued an announcement that the company received the first strategic investment of 500 million US dollars (approximately equivalent to 3.55 billion yuan) from Newtown Group. After the transaction is completed, Newtown Group’s shareholding proportion in Evergrande Auto accounts for 27.5% of the total number of outstanding common shares after the expansion. According to the agreement, under the condition of satisfying the preconditions in the agreement, Newtown Group will provide 600 million yuan of interest-free and guaranteed interim funds for Evergrande Auto’s research and development, production, and sales businesses. This sum of money is also regarded as Evergrande Auto’s “lifesaving money” by the outside world. The outside world believes that obtaining this investment will save Evergrande Auto.

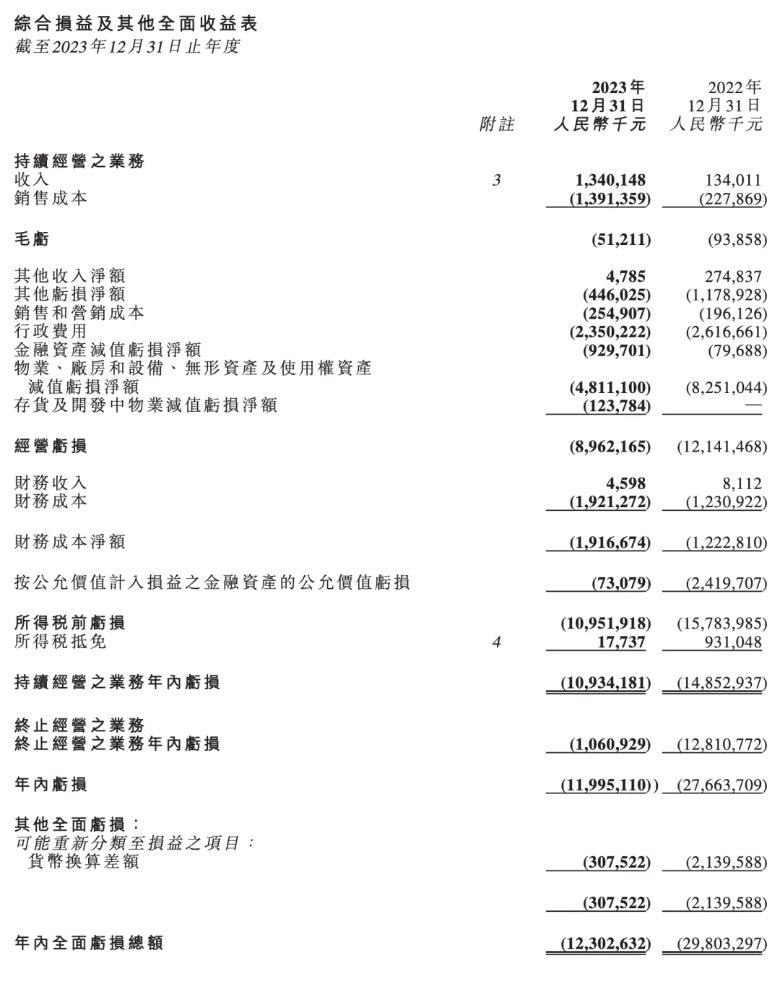

The latest financial report shows that in 2023, Evergrande Auto’s revenue was 1.34 billion yuan, a year-on-year increase of 900.03%; the shareholder’s attributable loss was 11.995 billion yuan, a year-on-year reduction in losses of 56.64%. As of December 31st, 2023, Evergrande Auto’s cumulative losses and shareholder losses were respectively 110.841 billion yuan (98.906 billion yuan in 2022) and 37.693 billion yuan (68.651 billion yuan in 2022). As of December 31st, 2023, Evergrande Auto’s total assets were 34.851 billion yuan, and the total liabilities were 72.543 billion yuan, including borrowings of 26.484 billion yuan, trade and other payables of 43.012 billion yuan, and other liabilities of 3.047 billion yuan. That is to say, Evergrande Auto has already been insolvent. As of December 31st, 2023, Evergrande Auto’s cash and cash equivalents were 129 million yuan, and the cash flow forecast can still be maintained for at least 12 months.

Nowadays, the cancellation of Evergrande Auto’s $500 million (approximately RMB 3.55 billion) investment transaction means that Evergrande Auto’s days will become increasingly difficult, and the only mass-produced model of Evergrande Auto – Hengchi 5 has also been rumored to stop production several times. On March 27th, in the announcement of releasing the financial report, Evergrande Auto stated that affected by external and internal factors, production and sales did not meet expectations, and the company faced operational difficulties. Research and development, production, and sales and other business activities and the stability of the staff team were affected. As of December 31, 2023, the Tianjin manufacturing base produced Hengchi 5 according to market demand, with a total of 1,700 vehicles produced offline and more than 1,389 vehicles delivered. Recently, due to financial reasons, the group arranged for some personnel to take a holiday and the Tianjin factory suspended production.

For Evergrande Auto with huge losses, obtaining $500 million may only be a drop in the bucket. But to some extent, although the strategic investment by Newton Group can far from pull Evergrande Auto out of the quagmire of the financial crisis, Evergrande Auto itself does not have the ability to generate blood. This sum of money can indeed ease the urgent need of Evergrande Auto. Previously, Evergrande Auto had emphasized that joining hands with Middle East capital will effectively solve the funding problem faced by the development of Evergrande Auto, so Newton’s strategic investment is also considered to be the only chance for Evergrande Auto. Now that Evergrande Auto has lost the $500 million (approximately RMB 3.55 billion) investment, it will also be in a very dangerous position. What’s worse, Evergrande Auto’s president and executive director, Liu Yongzhuo, was lawfully criminally detained on suspicion of illegal and criminal acts on January 8th. In addition, Xu Jiayin, the chairman of the board of directors of China Evergrande, and Du Liang, the general manager of Evergrande Wealth, have also been taken compulsory measures.

At present, “how to solve the pressure of funds” is still a difficult problem that Evergrande Auto urgently needs to solve, but there are not many choices in front of Evergrande Auto, and it will be very difficult for Evergrande Auto to survive. Or affected by the above news, Evergrande Auto in the Hong Kong stock market fell by 4.23%, and the total market value was 2.70 billion Hong Kong dollars.