The fourth largest global automaker, Stellantis Group, saw its profit almost halved in the first half of the year. The company promised to take measures, including shutting down unprofitable brands, to deal with the sharp decline in profit.

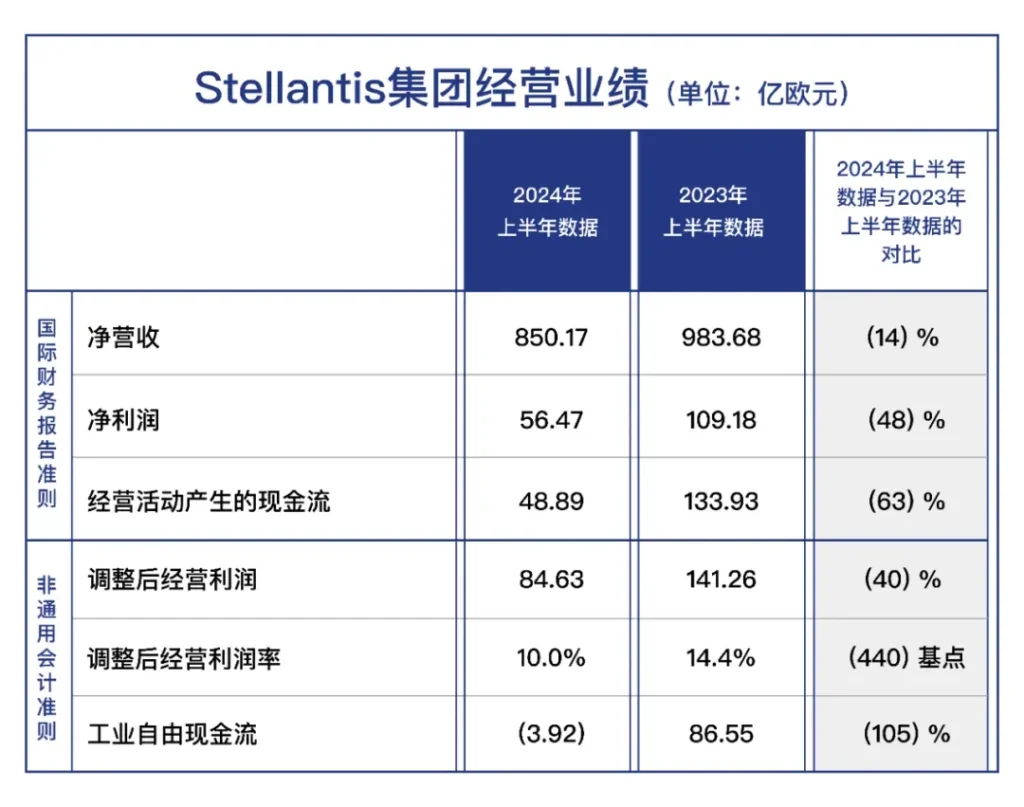

On July 25 local time, Stellantis Group released its operating results for the first half of 2024. The group achieved a net revenue of 85.017 billion euros, a year-on-year decrease of 14%; achieved a net profit of 5.647 billion euros, a year-on-year decrease of 48%; achieved an adjusted operating profit of 8.463 billion euros, and the adjusted operating profit margin was 10%.

The main reason for the decline in the financial performance of Stellantis Group in the first half of the year is the decline in sales volume and poor structure. Stellantis stated that the group’s implementation of inventory reduction measures, the transition period of many products entering a new generation, and the decline in market share in major markets such as North America are the main factors for the decline in sales volume. The profit margin in its main profit source, North America, has the most obvious decline.

The group CEO, Carlos Tavares, admitted in a statement that “the company’s performance in the first half of 2024 is lower than our expectations, which reflects both the challenging industry environment and our own operational problems.” It is understood that Stellantis Group will take measures to significantly cut costs and is expected to save 500 million euros in the second half of this year. At the same time, Stellantis Group will launch 20 new cars this year. The actions taken to improve the performance in North America, Europe, and Maserati will create opportunities for the improvement of performance in the second half of 2024 and the whole year of 2025.

In addition to product updates, Tavares also revealed the possibility of shutting down some unprofitable brands. Tavares said, “If they don’t make money, the group will close them. It can’t afford unprofitable brands.”

Stellantis Group completed the merger in 2021, which came from the merger of PSA Group and Fiat Chrysler Group with a 50:50 share ratio, and became the fourth largest automaker in the world after the merger. According to the group’s official website, currently Stellantis Group has 15 automotive brands, including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Fiat Commercial Vehicles, Jeep, Lancia, Maserati, Opel, Peugeot, RAM, Vauxhall, covering multiple market segments such as super-luxury, luxury, mainstream passenger cars, and even heavy pickup trucks, SUVs, and light commercial vehicles. In addition, there are also dedicated mobility, finance, parts and service brands.

Stellantis Group did not clearly state which brands would be shut down, but it is speculated that Lancia, DS, and Alfa Romeo are relatively risky brands because these brands are relatively niche and their sales share is not high. In addition, the Maserati brand may be sold. In the first half of the year, Maserati’s global sales volume decreased by more than 50% year-on-year, and the adjusted operating loss was 82 million euros.

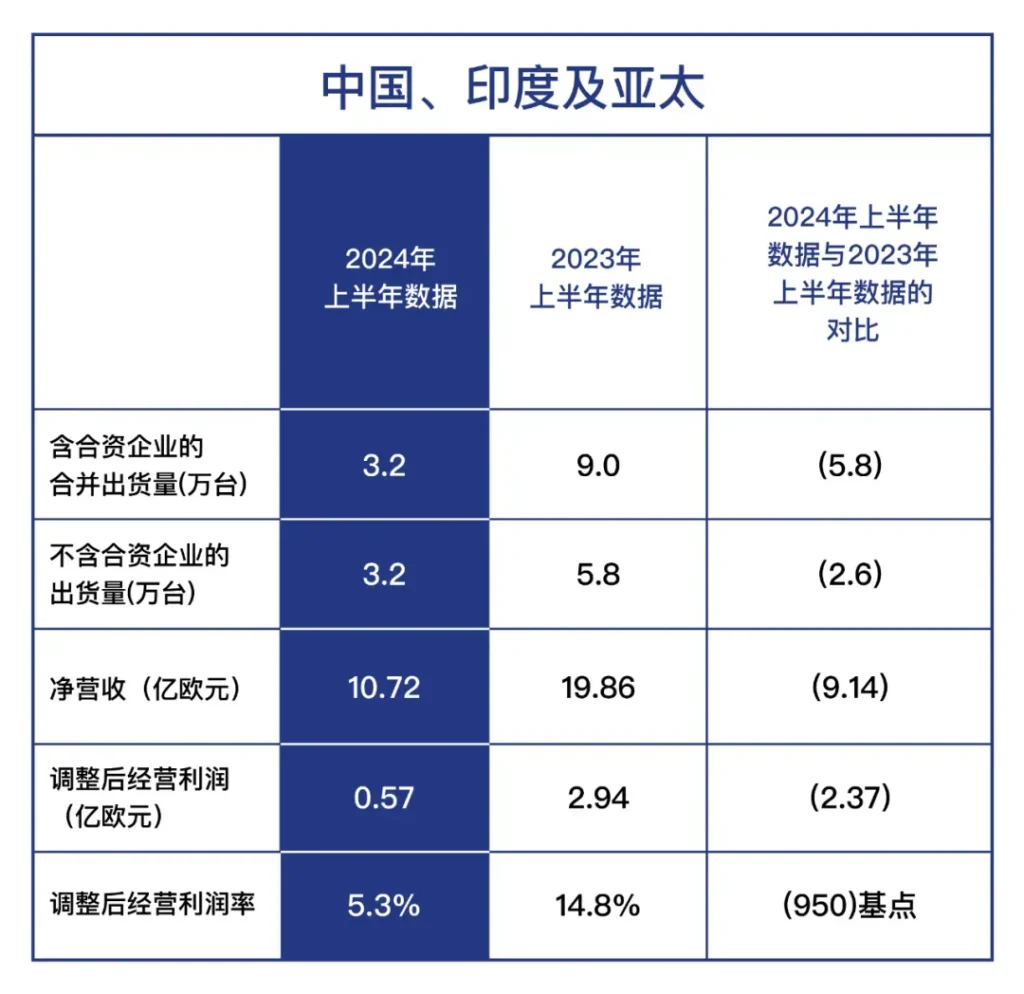

Stellantis Group is the only company that divides its performance by region. Among the 8.463 billion euros of operating profit in the first half of 2024, the North American region contributed more than half, which was 4.366 billion euros, and about 25% of the profit came from Europe, which was 2.060 billion euros. As for the Chinese market, Stellantis Group combined China, India, and the Asia-Pacific region for statistics. In the first half of the year, the operating profit was only 0.57 billion euros, which was almost negligible.

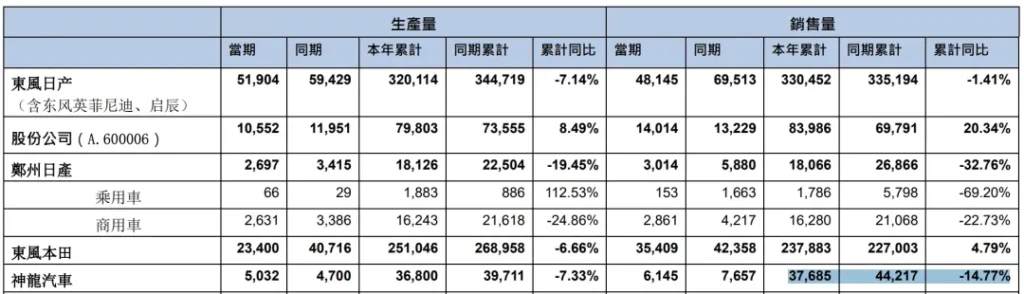

Stellantis Group’s performance in the Chinese market is very dismal. Previously, it had two joint venture companies, GAC FCA, which was jointly established with GAC Group, and Dongfeng PSA, which was jointly established with Dongfeng Company. The former mainly mass-produced Fiat and Jeep brand models, and the latter mainly mass-produced Peugeot and Citroën brand models. In 2022, GAC FCA applied for bankruptcy, and the Jeep brand under it was transferred to imports. The only remaining business of Stellantis Group in China is the joint venture Dongfeng PSA with Dongfeng Company, and the market performance of Dongfeng PSA is also hard to describe. In the first half of the year, the sales volume of Dongfeng PSA was 37,685 units, a year-on-year decrease of 14.77%.

Without powerful new energy products, Stellantis Group will have more difficulties in China in the future. In October 2023, Stellantis Group spent about 1.5 billion euros to acquire a 20% equity stake in the Chinese new car-making force, Leapmotor. At the same time, Stellantis Group and Leapmotor will establish a joint venture company “Leapmotor International” with a ratio of 51:49. Except for the Greater China region, this joint venture company has the exclusive right to carry out export and sales business to other markets around the world, and the exclusive right to manufacture Leapmotor products locally. Tavares said that now is the best time for Stellantis to support Leapmotor and play a leading role, and Stellantis will also profit in China and other markets through the competitiveness of Leapmotor.

According to the plan, by 2030, Stellantis will have more than 75 pure electric models, and the annual global sales volume of pure electric vehicles will reach 5 million units. By leveraging the technology of Leapmotor, Stellantis can promote the electrification transformation more quickly and at a lower cost, which is also a distinct example of its “careful calculation”.

Affected by the performance, the stock price of Stellantis Group has dropped significantly in the past two trading days. On the first day of announcing the financial report, it dropped by 7.7%. Currently, the latest stock price is 17.66 US dollars, and the total market value is 51.95 billion US dollars.