On August 1, the Chinese new car-making forces brands announced the sales results of July as scheduled. Combined with the sales released by various major auto brands and according to the final statistics of the ranking list by “Auto Industry Focus”, many new energy auto companies collectively broke out. Among them, Li Auto ranked first with vehicles, which was 51,000 units, an increase of 49% year-on-year, hitting a new historical high. Xiaomi Auto has delivered more than 10,000 units for two consecutive months.

Xiaomi Auto is the first new energy auto company to announce the sales publicly. The official announcement said that the delivery in July exceeded 10,000 units, but the specific quantity was not disclosed. At the same time, it was also said that the delivery in August would also be more than 10,000 units. However, due to the fact that Xiaomi Auto did not announce the specific sales, the delivery of 10,000 units could not be ranked in the top ten. In June this year, Xiaomi Auto delivered more than 10,000 units for the first time, which was 14,296 units, and the cumulative delivery since its listing was 30,000 units. It is understood that in 2024, Xiaomi Auto will deliver more than 100,000 units and strive for 120,000 units.

Li Auto delivered 51,000 new cars in July, an increase of 49% year-on-year, and once again won the sales champion of the new forces. As of the end of July, Li Auto has cumulatively delivered 239,981 units, ranking first in the total delivery volume of Chinese new forces brands. Although the phased setback of Li Auto’s pure electric route is a pity, the newly launched Li L6 performs brightly, and the sales of the entire L series are also gradually rising, and the basic situation is still stable.

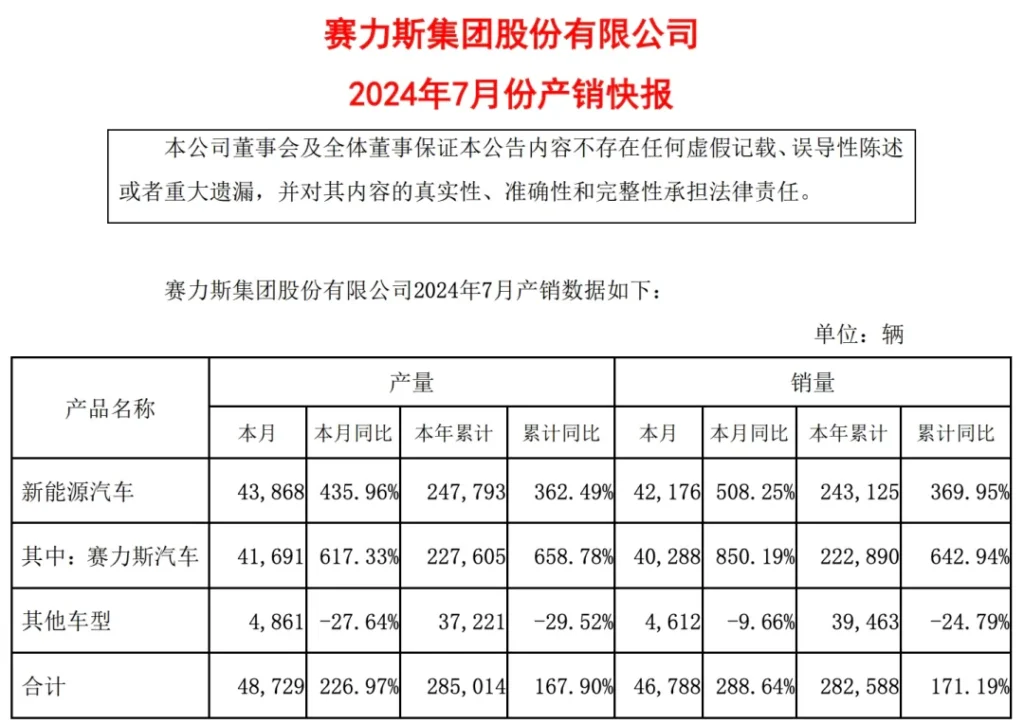

As the main competitor of Li Auto, Seres has newly released an announcement that its sales in July were 41,691 units, an increase of 617.33% year-on-year, and the cumulative sales from January to July were 227,605 units, an increase of 658.78%. At present, the models on sale under the AITO brand of Seres include the new M5, the new M7, and M9, and the M8 will be launched within the year. Due to the sharp increase in the sales of AITO, Seres is expected to make a profit in the first half of the year, with a net profit ranging from 1.39 billion to 1.7 billion, achieving a turnaround from loss to profit.

The overall performance of XPeng Motors is still average, continuing to stabilize above 10,000 units. It delivered 11,145 new cars in July, an increase of 1% year-on-year, among which XPeng X9 delivered 1,459 units. As of the end of July, XPeng Motors has cumulatively delivered a total of 63,173 new cars, an increase of 20% year-on-year. On July 3, XPeng MONA M03 was officially released, but only the exterior was released, and the interior is still in a state of secrecy. As the first model of the MONA series, MONA M03 adopts a new design and is positioned as a compact pure electric sedan with a maximum cruising range of up to 620 km, focusing on the market of 100,000 to 150,000 yuan. The new car will be officially launched in August and officially delivered in the third quarter.

As for NIO, its market performance in July was strong, being 20,498 units, and the sales have been stable above 20,000 units for three consecutive months. From January to July, NIO has cumulatively delivered 107,924 new cars, an increase of 43.85%. According to the annual sales target of 230,000 units set by NIO at the beginning of the year, the current achievement rate is 46.9%, which belongs to the first echelon among all new forces brands. To achieve the annual sales target of 230,000 units, the monthly average delivery in the next five months needs to reach 25,000 units, which is very challenging. If the current momentum can be continued, it is still very possible to break through 200,000 units in annual sales.

The sales of Nezha Automobile are also stable above 10,000 units, delivering 11,015 units in July, an increase of 9.7% year-on-year, but the overall performance is not strong, and its competitor Leapmotor has already exceeded 20,000 units in monthly sales. On June 26, the parent company of Nezha Automobile, Hozon New Energy Automobile Co., Ltd., submitted a listing application to the Hong Kong Stock Exchange. The documents show that from 2021 to 2023, Hozon Automobile suffered losses of 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan respectively.

In contrast, Leapmotor performed better, being 22,093 units, hitting a new historical high, an increase of 54.1% year-on-year. According to the news of the Stellantis Group, Leapmotor International shipped the first batch of Leapmotor electric vehicles from China to Europe this month. It is understood that Leapmotor International is a joint venture company established by the Stellantis Group and Leapmotor with a share ratio of 51:49, and will start selling Leapmotor C10 and T03 electric vehicles in nine European countries starting from September, and plans to expand its sales network in Europe to 200 by the end of 2024.

For other traditional auto companies’ high-end brands, Zeekr showed a month-on-month decline compared to last month, being 15,655 units. As the high-end brand of SAIC Motor, IM Motors delivered 6,015 units in July. In July, VOYAH Automobile delivered 6,015 units, an increase of 76%. As of the end of July, VOYAH Automobile has cumulatively delivered 36,391 units, while the sales target of VOYAH Automobile in 2024 is 100,000 units, and the current completion rate is only 36%, and the sales pressure is great.

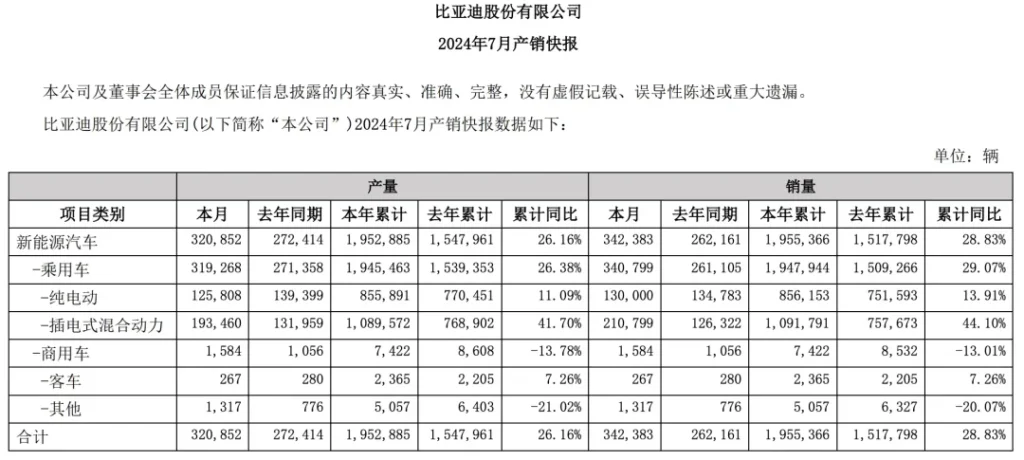

In addition, BYD’s wholesale sales in July were 342,383 units, an increase of 30.6% year-on-year, among which the Denza brand was 10,340 units, the Fangchengbao brand was 1,842 units, and the Yangwang brand was 439 units.

Looking at the new car sales market in July, except for individual enterprises, most auto companies are relatively balanced. In the second half of the year, new energy auto companies gradually shift to the competition of end-to-end autonomous driving. Coupled with the release of the second brands of NIO and XPeng Motors, the new energy market in the second half of this year may still have significant changes.

The China Passenger Car Association pointed out that the continuous strong promotion in the first half of the year has disrupted the normal price trend of the auto market. The terminal price repair requires some time to adapt. In addition, based on the results in the first half of the year, auto companies have also optimized and adjusted the market expectations, product structure, and sales rhythm. Some auto companies have refused the “involutionary” vicious competition, reduced the sales pressure, and improved the influencing factors of terminal prices, and the auto market has entered a flat period.