On July 24, Porsche released its first-half performance report for this year. According to the report, Porsche’s total revenue in the first half of the year was 19.46 billion euros, a year-on-year decline of 4.8%. The operating profit in the first half of the year was 3.06 billion euros, a year-on-year decline of 20.5%, and the operating return rate was 15.7%, which was 3.2% lower than 18.9% in the same period of last year. In terms of sales volume, the global sales volume in the first half of this year was 155,900 vehicles, a year-on-year decline of 6.8%. Among them, there was a significant drop in sales in the Chinese market. The sales volume in the first half of the year was only 29,600, a year-on-year sharp decline of 33%.

Regarding this performance report, the official said that after experiencing a decline in the first quarter, the operating return rate in the second quarter recovered to 17%, which was at the upper limit of the expected value. Porsche’s operating return rate in the first quarter was 14.2%. Driven by the good performance in the second quarter, the operating return rate in the first half of the year achieved a level of more than 15%. In response to the significant drop in sales in the Chinese market, Porsche responded: This is mainly due to the decline in sales in the Chinese market and the switch between old and new models.

In fact, it is not unexpected that Porsche’s first-half performance data is not ideal. As early as the beginning of July, the official had publicly announced the global sales volume in the first half of this year. At that time, from the data released by the official, it could be seen that in the first half of the year, Porsche had a decline in sales in both the North American market and the Chinese market. As the main sales market of Porsche, the Chinese market has continued to decline in sales since 2022. The data shows that the total sales volume in the Chinese market in 2022 was 93,286 vehicles, a year-on-year decline of 2.5%, becoming the only market in Porsche’s global sales that declined. Porsche’s global sales volume in 2023 was 320,221 vehicles, a year-on-year increase of 3%, but the sales volume in the Chinese market has not improved and still declines. Last year, the total sales volume in the Chinese market of Porsche was 79,283 vehicles, a year-on-year decline of 15%.

Of course, the decline in sales of Porsche in the Chinese market is somewhat related to the slow electrification transformation and the rapid development of the domestic new energy vehicle market, resulting in a reduction in the market share of fuel vehicles. Porsche announced the electrification transformation in 2019 and launched its first pure electric sports car, the Taycan, in the same year, but the sales volume of the first model was not satisfactory. The data shows that the sales volume of the Taycan model in the Chinese market last year was only 4,151 vehicles. From the perspective of Porsche’s product structure, most of its sales still come from fuel models. And the acceleration of the domestic electrification transformation has also led to a reduction in the demand for domestic fuel vehicles, and the demand for imported fuel vehicles has also decreased significantly.

The decline in sales and the poor sales of pure electric models have also put great pressure on domestic Porsche dealers, who have to sell cars at a loss. In May, due to this problem, Porsche dealers in China also launched a collective protest and resistance. At that time, the official response said: Porsche is committed to value growth-oriented development and is fully accelerating the electrification process. In this transformation process, Porsche hopes to jointly face various challenges with long-term cooperative dealer partners, support each other, and achieve win-win development. Porsche will unswervingly put the interests of customers first and work hand in hand with dealers to jointly respond to market challenges and seek development.

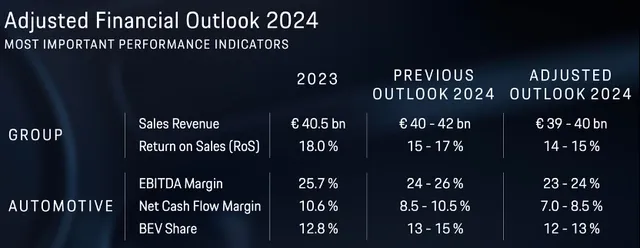

Recently, in addition to soothing domestic dealers, the official has also made adjustments in personnel, product aspects, and performance goals. On July 20, the official announced that Alexander Pollich will succeed Michael Kirsch to take over as the CEO of Porsche China. Responsible for the company’s business in the Chinese mainland, Hong Kong, and Macau regions. According to the official introduction, Alexander Pollich has rich sales experience. On the day before the official announced the first-half performance, the official also lowered this year’s performance goals. In terms of sales amount, it was reduced from the earlier expected 40 billion to 42 billion euros to 39 billion to 40 billion euros. In terms of sales return rate, it was also lowered from the previously expected 15% to 17% to 14% to 15%.

At the same time, in terms of product planning, it also gave up the goal of increasing the sales share of electric vehicles to 80% by 2030 as planned earlier. The official said that several electric models will still be launched in the next few years, but at present, the speed of the transformation to electric vehicles is indeed slower than expected, and the 80% goal commitment is too radical.

Regarding the performance in the Chinese market, Porsche CEO Oliver Blume once said that although the Chinese market still faces challenges, it does not intend to join the price war to deal with market changes. Subsequent evaluations of the global cost structure will be carried out and strategic adjustments will be given priority. Blume believes that Porsche is expected to achieve a medium-term sales return rate target of 17-19% in 2025. Judging from the official statement, it is still very optimistic about Porsche’s subsequent performance in China, but in fact, with the rise of domestic new car-making forces, the market share of traditional luxury brands has obviously been threatened. In other words, the time left for luxury brands to transform is already very urgent. Facing this series of challenges in the future, how should Porsche break the situation?