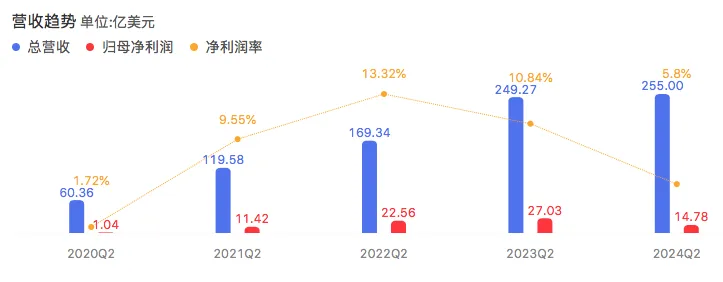

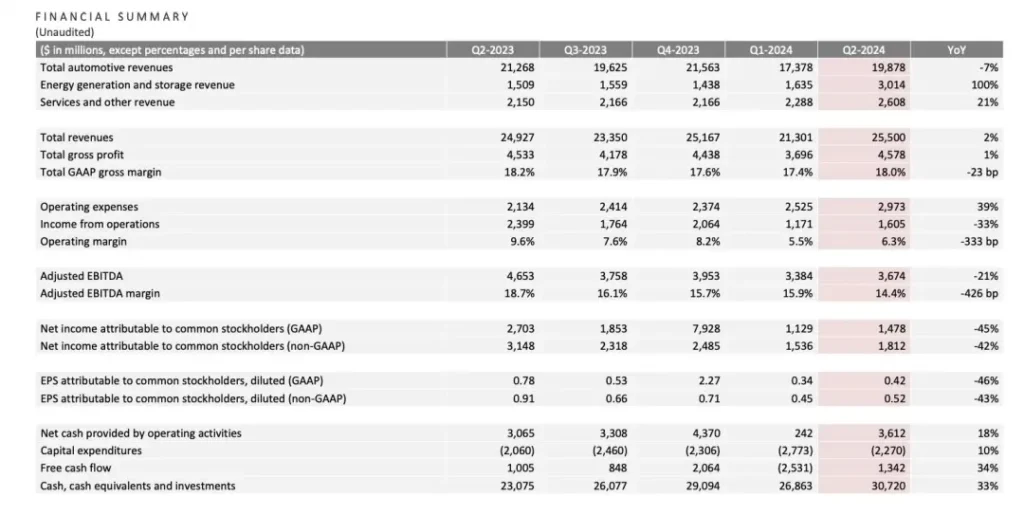

On July 24, Tesla released its financial report for the second quarter of 2024. The data shows that in the second quarter of 2024, Tesla’s revenue was 25.5 billion US dollars, with a slight increase of 2.30% year-on-year; in terms of net profit, Tesla’s performance was not optimistic, which was 1.478 billion US dollars, with a year-on-year decline of 45.32%; the gross profit was 4.578 billion US dollars, and the gross profit margin was 18%.

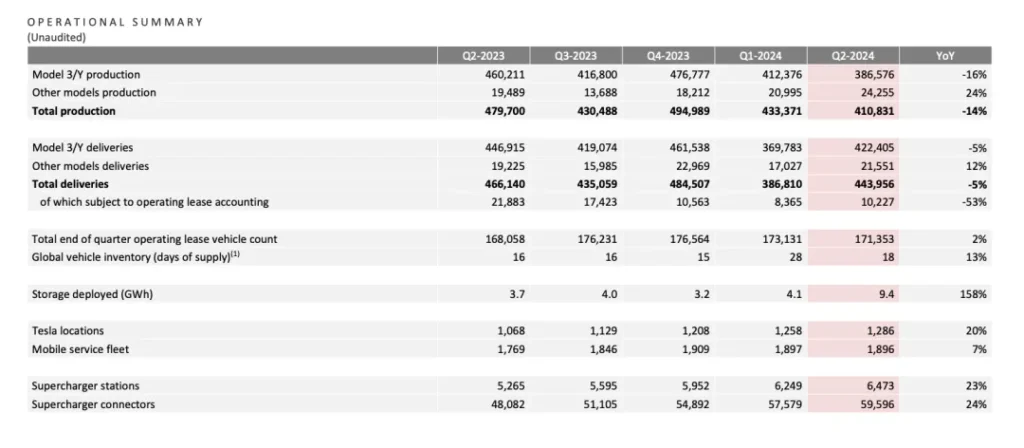

The automotive business is the pillar product of Tesla. In the second quarter of this year, the revenue of this business was 19.878 billion US dollars, with a year-on-year decline of 7%. In terms of the production and sales of new cars, in the second quarter of this year, Tesla globally produced a total of 410,800 cars cumulatively, with a year-on-year decline of 14% and reaching a new low in the past five quarters. Among them, the cumulative production of Model 3 and Model Y was 386,600 cars, with a year-on-year decline of 16%; in the second quarter, Tesla delivered a total of 444,000 new cars cumulatively, with a year-on-year decline of 5%. This is the first time that Tesla has experienced a consecutive two-quarter year-on-year decline in sales, but it has increased quarter-on-quarter, with a quarter-on-quarter increase of 14%.

Regarding the financial report performance, Tesla said that the increase in revenue in the second quarter benefited from the growth of the energy production and storage business and the reduction of the average selling price of its models; as for the decline in net profit, Tesla said that the profit was mainly affected by the “increase in operating expenses driven by the artificial intelligence project” and the “restructuring expense”. It is understood that in April this year, Tesla announced that it will lay off 10% globally, and due to the impact of the layoffs, Tesla reported a restructuring expense of 622 million US dollars.

Perhaps due to the fact that the financial report did not meet the market expectations, Tesla’s stock price fell sharply by 7% after the market closed. As of the close of the US Eastern Time on July 23, Tesla’s stock price was quoted at 246.380 US dollars, a decrease of 2.04%, and the total market value was 785.8 billion US dollars.

In the past 2023, Tesla’s global sales volume was 1.8086 million units, creating a brilliant achievement. But it cannot be denied that after entering 2024, Tesla’s days are not easy, especially in the Chinese market. In April this year, Elon Musk, the CEO of Tesla, released an all-staff letter and announced that Tesla will lay off 10% globally. At that time, industry insiders pointed out that the layoffs of Tesla may be related to the decline in the delivery volume in the first quarter. The data shows that Tesla delivered a total of 386,800 new cars, with a year-on-year decline of 8.5%, which was the first time it fell below 400,000 units since the third quarter of 2022, far lower than the most pessimistic analyst’s expectations.

Up to now, Tesla’s global models on sale include a total of four models: Model 3, Model Y, Model S and Model X. The latter two are not very prominent in China due to their high prices and being imported models. Model Y is Tesla’s first domestically produced SUV model and also an important source of sales volume in the Chinese market. Taking the retail data in the first half of 2024 as an example, Tesla’s cumulative sales volume in China was 278,317 units, among which Model Y was 207,817 units, accounting for 74.67% of the total sales volume; Model 3 was 70,500 units.

It should be noted that with the rise of domestic electric vehicles and the increase of similar-level products, Tesla’s sales volume in the Chinese market has begun to decline. Data from the Passenger Car Association shows that in June, Tesla’s sales volume in China was 71,000 units, with a year-on-year decline of 24% and a quarter-on-quarter decline of 2.2%, while the sales volumes of car companies including BYD, Li Auto, NIO, and Leapmotor all showed a year-on-year growth trend during the same period.

Perhaps to boost sales volume, on July 23, Tesla’s Chinese official website showed that the deadline for the limited-time 5-year 0-interest activity of some models of Model 3 and Model Y was extended from July 31 to August 31, but this activity only covered the rear-wheel drive version and the long-range all-wheel drive version, not including the high-performance version. On the contrary, Tesla raised the prices of Model S and Model X in the US market by 2,000 US dollars each.

At this teleconference financial report meeting, Musk said that it will apply for regulatory approval in China and Europe to implement the supervised FSD (Full Self-Driving System), and it is expected to obtain approval by the end of the year. FSD is a set of self-driving systems developed by Tesla and is regarded as the key to stimulating the growth of Tesla’s sales volume in the Chinese market. In addition, Musk said that it will start to produce a low-priced model in the first half of 2025, but did not disclose specific information about the new car because he was worried that the news of the new car would affect the sales volume of the existing models.

In short, in the second half of this year, Tesla’s sales sources still rely on Model 3 and Model Y, but due to the slow update and replacement speed of Tesla’s models, its product competitiveness has been significantly inferior to before, and its first electric pickup Cybertruck is still in the climbing stage. For Tesla, it urgently needs to launch a high-volume model to stimulate sales growth, but the low-priced electric model will not be launched until 2025. In this context, Tesla is also facing not small pressure. But as early as the beginning of the year, Tesla had already released a dangerous signal, and it is expected that the growth rate of new car deliveries within the year may be significantly lower than the growth rate in 2023. Tesla pointed out that the main reason is that Tesla’s Texas Super Factory is preparing for the launch of the next-generation new car. Judging from the sales volume in the first half of the year and the latest financial report performance, “how to get through the second half without a significant decline in profit” is still the biggest test currently faced by Tesla.