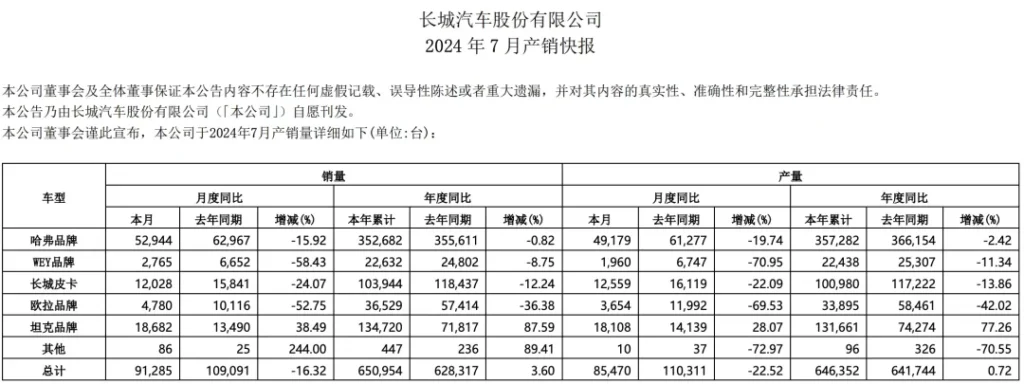

On August 1, Great Wall Motor announced the production and sales express of July to the outside world. The data shows that the sales volume of Great Wall Motor in July was 91,300 vehicles, a year-on-year decline of 16.32%, and the sales volume has declined year-on-year for three consecutive months. The cumulative sales volume from January to July was 651,000 vehicles, an increase of 3.60% year-on-year. Among them, the overseas sales volume in July was 38,200 vehicles, and the cumulative overseas sales volume from January to July was 239,700 vehicles. The sales volume of new energy vehicles in July was 24,100 vehicles, and the cumulative sales volume from January to July was 156,500 vehicles. Compared with the annual sales target of 1.6 million vehicles set at the beginning of the year, Great Wall Motor has only completed 40%, and it is quite difficult to achieve.

Compared with mainstream automobile manufacturers, such as BYD, Chery, Geely, etc., they all achieved year-on-year growth. Among them, the sales volume of BYD Automobile increased by 31% year-on-year, the sales volume of Geely Automobile increased by 13% year-on-year, and the sales volume of Chery Automobile increased by 20% year-on-year, while Great Wall Motor is currently the only private automobile manufacturer with a year-on-year decline in sales volume. It has declined year-on-year for three consecutive months, and the sales growth rate in the first 7 months is also much lower than that of other manufacturers.

Like in June, among the sub-brands of Great Wall Motor in July, only Tank achieved growth, while Haval, Ora, WEY, and Great Wall all declined year-on-year. Especially WEY and Ora were directly halved.

The Tank brand is the only brand to achieve growth, and it has achieved a sharp increase. The sales volume in July increased by 38.49% year-on-year to 18,700 vehicles, and the cumulative sales volume from January to July increased by 87.59% to 134,700 vehicles. Different from other brands, the vehicle models of the Tank brand perform relatively evenly. The currently available models include the Tank 300, the Tank 400, the Tank 500, and the Tank 700. Among them, the Tank 300 is the main sales model. The cumulative sales volume in the first 6 months was 41,800 vehicles, followed closely by the Tank 500 Hi-T and the Tank 400 Hi-T at 20,200 vehicles and 19,500 vehicles.

It is worth mentioning that on July 16, the Tank brand released an announcement that the Tank Chongqing factory will be shut down from July 23 to July 31, and the Tank Xushui factory will be shut down from July 24 to July 31, and the Tank Jingmen factory will be shut down from July 25 to July 31. The Tank brand said, “The summer temperature continues to rise. In order to effectively ensure production safety and ensure the stable operation of equipment, it is planned to conduct safety inspection and maintenance work on the equipment of the Tank factory in the second half of July 2024.” Perhaps if there is no high temperature shutdown, the sales volume of the Tank brand may be higher, and its year-on-year growth in June was 104.02%.

WEY can be described as the worst, and its monthly sales are still at the level of 2,000 vehicles, which is 2,765 vehicles, a year-on-year decline of 58.43%. It is understood that currently there are only three models on sale for the WEY brand, namely the Lishan, the Gaoshan, and the Mocha, and the main source of sales is the Lishan. This medium and large SUV has accumulated a sales volume of 13,711 vehicles in the first half of the year. On August 2, Great Wall Motor announced that the new Lishan has officially started booking. The pre-sale price of the Intelligent Driving Max version is 308,800 yuan, and the pre-sale price of the Intelligent Driving Ultra version is 335,800 yuan.

As for the Ora brand, it is also halved. The sales volume of the Ora brand in July was 4,780 vehicles, a year-on-year decline of 52.75%. Currently, there are only three models on sale for the Ora brand, namely the Good Cat, the Ballet Cat, and the Lightning Cat. No new cars have been launched in 2023 so far, and the overall sales volume is still borne by the Ora Good Cat. Its cumulative sales volume in the first half of the year was 21,968 vehicles, and the Lightning Cat was only 1,500 vehicles, and the Ballet Cat was 719 vehicles.

The Haval brand, as the sales pillar of Great Wall Motor and the weather vane of Great Wall Motor, accounts for more than half of its overall sales. The data shows that the sales volume of the Haval brand in July was 52,900 vehicles, a year-on-year decline of 15.92%. Great Wall Motor did not announce the specific sales volume of individual models. According to the previous sales trend, the model with the highest sales volume in the Haval brand is still the Haval H6. The new generation of the Haval H6 was launched on June 19, and the price range is 11.79-14.39 yuan. It is understood that this is the fourth generation of the Haval H6 since its birth. The new generation of the Haval H6 is built based on the Great Wall Lemon platform and adopts a brand-new exterior and interior design.

Great Wall Motor, which is in the critical stage of new energy transformation, with the launch of more and more new energy vehicles, its presence in the domestic new energy vehicle market is getting stronger and stronger. The data shows that the cumulative sales volume of new energy vehicles from January to July 2024 was 156,500 vehicles, and the sales volume of new energy vehicles in July was 24,100 vehicles.

At the same time, Great Wall Motor is also accelerating the promotion in the overseas market. The data shows that the overseas sales volume of Great Wall Motor from January to July 2024 was 239,700 vehicles, of which 38,200 vehicles in July. It is understood that many models including the Ora Good Cat, the Haval H6 HEV, and the Tank 500 HEV have been launched in many overseas markets such as Brazil, Vietnam, and Indonesia. With the expansion of overseas business, the overseas market is also expected to become a new growth point for the sales volume of Great Wall Motor.

Previously, Great Wall Motor released the semi-annual performance forecast for 2024. The financial report shows that Great Wall Motor expects the net profit attributable to shareholders of the listed company in the first half of the year to be 6.5 billion to 7.3 billion yuan, an increase of 377.49% to 436.26%; the net profit after deducting non-recurring is 5.0 billion to 6.0 billion yuan, an increase of 567.13% to 700.56%.