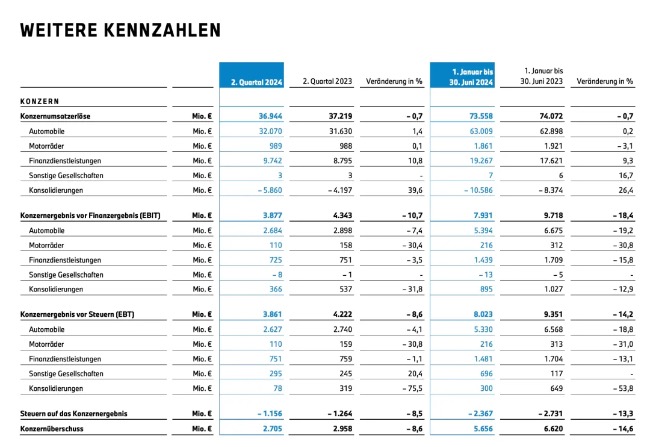

Recently, the BMW Group released its financial report for the first half of 2024. The report shows that the total revenue of the automotive business of the BMW Group in the first half of the year was 63.009 billion euros, basically the same as the 62.898 billion euros in the same period last year. Although the overall revenue was basically the same as that in the same period last year, its pre-tax profit decreased by 14.2% compared with the same period last year. The data shows that the pre-tax profit of the BMW Group in the first half of the year was 8.023 billion euros, compared with 9.351 billion euros in the same period last year.

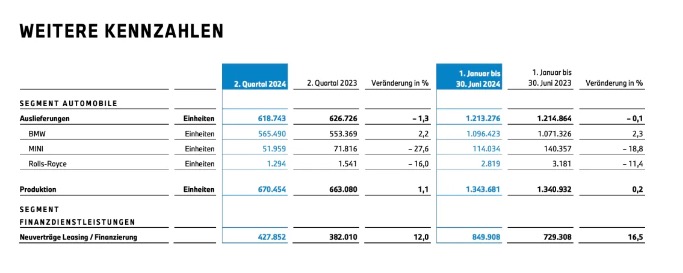

In terms of sales volume, in the first half of 2024, the BMW Group delivered a total of 1.213 million new cars (including BMW, MINI, and Rolls-Royce) in the global market, a year-on-year decrease of 0.1%. Among them, the BMW brand sold a total of 1.096 million units, a year-on-year increase of 2.3%, and the other two brands both decreased. Rolls-Royce decreased by 11.4% year-on-year, and MINI decreased by 18.8% year-on-year.

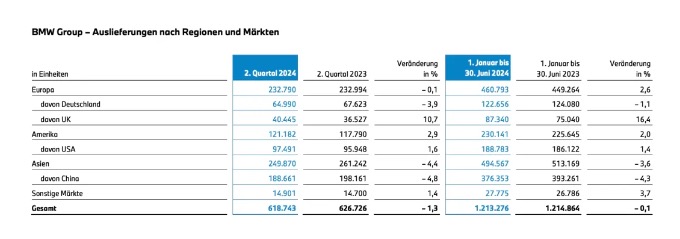

From the global market perspective, the sales volume of BMW in Europe in the first half of the year was 460,800 units, a year-on-year increase of 2.6%, and the British market was the market with the largest growth rate for BMW, with a year-on-year increase of 16.4%; from other markets, BMW also achieved growth in the North American market, with sales volume of 230,100 units, a year-on-year increase of 2.0%, among which the US market was 188,800 units, a year-on-year increase of 1.4%.

The Chinese market is the market with the largest decline in sales volume for the BMW Group. In the first half of the year, the BMW Group delivered 494,600 new cars in the Asian market, a year-on-year decrease of 3.6%, among which 376,400 units were delivered in the Chinese market, a year-on-year decrease of 4.3%. Of course, although there is a decline in sales volume in the Chinese market, it is still the largest single market of the BMW Group globally, accounting for 31% of the total global sales volume of the BMW Group. Regarding the reason for the decline in sales volume in the Chinese market, the BMW Group said that BMW and its peers are under pressure in the key market of China, and Chinese local automakers are winning market share with lower-cost electric cars, forcing its European competitors to significantly reduce prices.

Since the beginning of this year, the price war in the automotive industry has spread to the luxury car field, and luxury brands including BMW have had to be forced to join the price war. The terminal market prices of many models under the brand have dropped significantly, resulting in a situation where many 4S stores suffer losses when selling cars.

At the end of May this year, BMW sent a letter to all dealer stores stating that in view of the general market background and the huge impact brought by domestic brands, it decided to offer a number of substantial subsidy reduction policies to BMW 4S stores, aiming to help dealers deal with short-term difficulties and relieve business pressure. After the policy was introduced, the prices of many BMW models dropped significantly, mainly including the pure electric series such as the i3 and ix3, and now it can be purchased at a price of less than 200,000. However, the traditional luxury brands’ price reduction for selling cars has not been able to stimulate the growth of terminal market sales. Since the end of June, BMW has gradually withdrawn from the price war. BMW China said that in the second half of the year, BMW will focus on business quality in the Chinese market and support dealers to make steady progress.

It is undeniable that the price war does bring quite a lot of pressure to dealers, and 4S stores almost fall into a vicious circle of losing money when selling cars. Not only that, but price reduction sales also damage the brand value. Once representing luxury, BMW, Mercedes-Benz, and Audi have now gradually declined, and the market share has begun to be eroded by independent new energy brands.

At present, the automotive market has sufficient supply. In the context of the global economic slowdown, the reason why multinational auto companies have the phenomenon of “increasing revenue but not profit” is on the one hand that some auto companies had a relatively high profit level in the early stage, and it is relatively difficult to continue to obtain relatively high growth in the stock competition of the automotive industry; on the other hand, the decline in the unit sales price and the increase in promotional efforts have also brought certain pressure to the profit level of multinational auto companies.

In addition to BMW, the performance of other auto companies such as Volkswagen, Renault Group, Tesla, Ford, and Nissan is all “increasing revenue but not profit”. The Stellantis Group has a double decline in revenue and profit, and only Toyota and Hyundai have achieved a double increase in revenue and profit.

At present, the entire luxury car market is facing the challenges of declining sales and electric transformation, especially the brand premium of luxury brands in the past many years is difficult to be transmitted to electric vehicle products, and the electric vehicle products currently launched by BBA all show a situation of a significant drop in terminal prices. According to the plan, in 2025, the new-generation models of BMW will be launched in the global market, and at least six models will be put into production within the next two years. The new cars will be equipped with a new electrical and electronic architecture, a new user interface and human-computer interaction concept, and a new high-performance electric drive battery system.