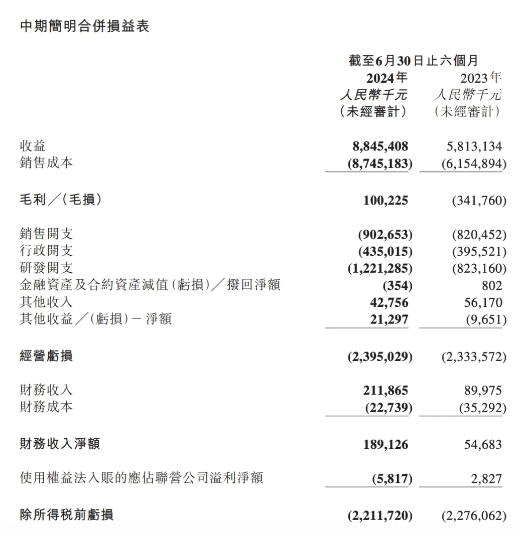

On the evening of August 15th, Leapmotor released its financial report for the first half of 2024. The financial data shows that in the first half of 2024, Leapmotor’s operating income was 8.85 billion yuan, a year-on-year increase of 52.2%, and the growth rate was among the top among new forces; the net loss was 2.212 billion yuan, a year-on-year narrowing of 2.8%; the gross profit margin was 1.1%, a significant improvement compared to the same period. For reference, Leapmotor’s gross profit margin in the first quarter was -1.4%, and it improved to 2.8% in the second quarter.

Leapmotor stated that the growth in the gross profit margin was mainly due to the scale effect brought by the increase in sales and continuous cost control. It is expected that the gross profit margin will perform better in the second half of the year. As for the improvement in gross profit during the reporting period but no significant narrowing of losses, it was because of increased research and development investment in the first half of the year, especially in the second quarter, including the development of future new models and increased investment in the development of intelligent driving technology. Among them, the research and development expense was 1.221 billion yuan, a year-on-year increase of 48.4% compared to the same period in 2023.

As of the end of June, Leapmotor’s net cash inflow from operating activities was 270 million yuan, and the available funds on hand were abundant, reaching 16.49 billion yuan, and the asset-liability structure maintained a healthy level.

As an automaker, Leapmotor’s revenue performance is closely related to its delivery performance. In the first half of the year, Leapmotor delivered a cumulative total of 86,696 vehicles, a year-on-year increase of 94.8%, setting a historical high for the first half of the year. According to the plan, Leapmotor’s annual sales target for the year is 250,000 to 300,000 vehicles. Calculated based on 250,000 vehicles, it means that Leapmotor’s target completion rate in the first half of the year was 34.68%.

Looking back at Leapmotor’s development process, it has been established for 9 years since 2015, but the real development has been in recent years. In September 2022, Leapmotor rang the bell and listed on the Hong Kong Stock Exchange, becoming another new car-making force to land on the Hong Kong stock market after NIO, Xpeng, and Li Auto. However, in contrast, Leapmotor is still in a loss state at present. The financial report data shows that in 2023, Leapmotor’s net loss was 4.216 billion yuan, narrowing compared to the net loss of 5.109 billion yuan in 2022.

Up to now, Leapmotor’s currently available models include Leapmotor S01, Leapmotor T03, Leapmotor C11, Leapmotor C01, Leapmotor C11 Extended Range, Leapmotor C10, and Leapmotor C16. Among them, the Leapmotor C10 was launched on March 2nd, with a total of 7 models, and the price range is 128,800 – 168,800 yuan; the Leapmotor C16 was launched on June 28th, with a total of 6 models, and the price range is 155,800 – 185,800 yuan. This vehicle is positioned as a 6-seat medium and large SUV, with two options of extended range and pure electric power. The official stated that the cumulative number of firm orders for the C16 exceeded 10,000 in the first month of its launch, making it the model with the largest number of orders in the first month of its launch for Leapmotor.

In addition to launching new products, Leapmotor is also actively exploring overseas markets. On May 14th this year, Leapmotor and Stellantis Group jointly held a press conference and announced the official establishment of the joint venture Leapmotor International B.V. (Leapmotor International), in which Leapmotor holds 49% of the shares and Stellantis Group holds 51%. According to the plan, Leapmotor International plans to start sales and deliveries of the C10 and T03 in Europe from September 2024. Up to now, nearly 2,000 C10 and T03 have been continuously transported to Europe by sea.

It is understood that within the next 2 years, Leapmotor will further launch competitive models. Zhu Jiangming, the founder, chairman, and CEO of Leapmotor, disclosed at the 2024 interim results conference call that Leapmotor’s goal is to become one of the top eight in sales among all automotive groups in the Chinese market this year. It should be noted that with the continuous intensification of competition in the new energy track, Leapmotor is bound to face fierce competition.

The latest data shows that in July, Leapmotor’s delivery volume was 22,100 vehicles, a year-on-year increase of 54.12%, setting a historical high for monthly deliveries. It is also the second consecutive month that its delivery volume exceeded 20,000 vehicles. It is expected that Leapmotor can complete its sales target as scheduled. However, compared with other new car-making forces, Leapmotor still has room for improvement in terms of delivery volume. For reference, Li Auto’s delivery volume in July was 51,000 vehicles, a year-on-year increase of 49.41%, setting a historical high for monthly deliveries.