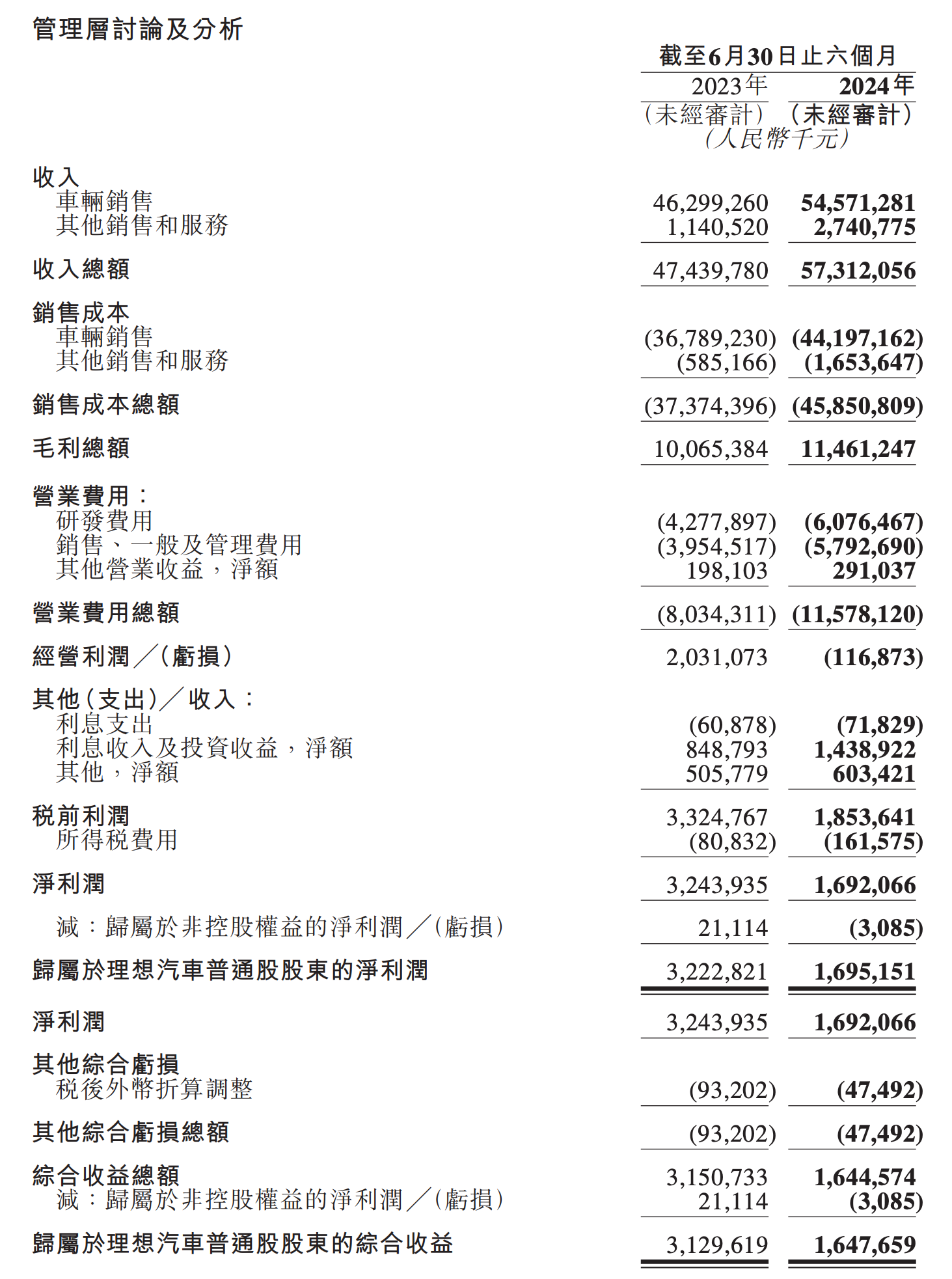

On the evening of August 28th, Li Auto released its financial report for the first half of 2024. The financial report shows that in the first half of the year, Li Auto’s revenue was 54.57 billion yuan, an increase of 20.8% year-on-year; the net profit was 1.69 billion yuan, a decline of 47.8% year-on-year; the adjusted net profit was 1.65 billion yuan, a decline of 47.2% year-on-year. Increased revenue but not profit, and the profit per vehicle declined significantly. In terms of gross margin, Li Auto’s gross margin in the first half of the year was 20.0%, compared with 21.2% in the same period. The vehicle gross margin of Li Auto was 19.0%, compared with 20.5% in the same period. The decline was due to the different product mix and pricing strategy changes in the two quarters, partially offset by cost reductions. Before the launch of the Li Auto L6, the main sales forces of Li Auto were the L7, L8, and L9. After the Li Auto L6, the main sales force of Li Auto became the Li Auto L6. Although this model brought sales growth to Li Auto, the profit of this model was not high, which was the reason why Li Auto increased revenue but not profit. At the same time, in terms of research and development expenses, Li Auto’s research and development expenses were 3 billion yuan, an increase of 42.0% year-on-year; sales, general and administrative expenses were 5.8 billion yuan, an increase of 46.5% year-on-year. In terms of new vehicle deliveries, Li Auto delivered a cumulative 189,000 vehicles in the first half of the year, an increase of 35.84% year-on-year, continuing to lead the new car-making forces. Among them, 108,600 vehicles were delivered in the second quarter, an increase of 25.5% year-on-year. Regarding the financial performance of Li Auto, Li Auto’s CFO Li Tie said that as the production of the Li Auto L6 stabilizes and various cost reduction and efficiency improvement measures fully take effect, the profit margin level and cash flow may improve in the second half of the year. Previously in May, Li Auto’s CFO Li Tie once said that the second quarter would be the most difficult quarter experienced by Li Auto this year. The reason behind it may be related to the performance of the Li Auto MEGA after its launch being lower than expected. Up to now, the models on sale under Li Auto include the Li Auto L7, Li Auto L8, Li Auto L9, Li Auto L6, and Li Auto MEGA, totaling 5 models. Among them, the Li Auto MEGA is the fourth new vehicle under Li Auto and also the first pure electric MPV under Li Auto. It was launched on March 1 this year. The new vehicle only launched one model with a price of 559,800 yuan. At the new vehicle launch event, Li Auto’s CEO Li Xiang said that the MEGA will be the next hit product of Li Auto and is confident of becoming the number one in sales above 500,000; thereafter, Li Auto’s Vice President of Commerce Liu Jie also pointed out in an interview with the media that the goal of the Li Auto MEGA is to challenge a monthly sales volume of 8,000 units and become the number one in sales above 500,000. But contrary to expectations, the market performance of the MEGA after its launch was far lower than expected. Retail data shows that the sales of the MEGA from March to June this year were 3,229 units, 1,145 units, 614 units, and 589 units respectively. Industry analysts believe that the orders for the Li Auto MEGA were lower than expected. On the one hand, it was because the vehicle price was too high. On the other hand, it was because the vehicle’s appearance design was highly polarized, affecting word-of-mouth. In contrast, the Li Auto L6, which was launched in April, was very successful after its launch. This vehicle is positioned as a five-seat medium-sized SUV and launched Pro and Max models with prices of 249,800 yuan and 279,800 yuan respectively. It is the first model of Li Auto priced below 300,000 yuan. Retail data shows that the sales of the Li Auto L6 from April to June were 2,381 units, 12,965 units, and 23,864 units respectively, showing a gradually rising trend, especially a particularly rapid growth in June. Undoubtedly, this vehicle has become a hit model under Li Auto. For the sales expectations in the next third quarter, Li Auto expects the delivery volume to be 145,000 to 155,000 units, an increase of 38.0% to 47.5% year-on-year; the expected total revenue is 39.4 to 42.2 billion yuan, an increase of 13.7% to 21.6% year-on-year. As for the longer-term product planning, at the earnings call, Li Xiang revealed that in the first half of next year, Li Auto will release a new pure electric SUV model. The three models may be named M7, M8, and M9, positioned to meet the needs of family users. According to the previous product planning of Li Auto, by 2025, Li Auto will have 5 range-extended models, 1 super flagship, and 5 pure electric models. In the financial report, Li Xiang said that for pure electric SUVs, Li Auto needs to solve two problems. One is the styling design of the product, and the other is to be able to provide users with more than 2,000 supercharging stations when delivering pure electric products. Li Xiang believes that Li Auto is still very confident in the competitiveness of pure electric SUVs and hopes to enter the first echelon of high-end pure electric products in about two years. According to another report, Li Auto’s President Ma Donghui revealed that the overall progress of pure electric product research and development is normal. Currently, multiple small batch prototype tests and production have been completed. The vehicle production plant has been completed, and the overall progress of the industrial chain capacity preparation can also meet the sales demand. Core components are in performance testing. As of the close of trading on August 28th, US Eastern Time, Li Auto’s US stocks closed at $17.800, down 16.12%, approximately 25.5 billion yuan. Affected by the US stock market, Li Auto’s Hong Kong stocks plunged 9.75% on August 29th, with a total market value of 155.2 billion yuan.

Evaporation of 25.5 billion! Li Auto takes a heavy blow.