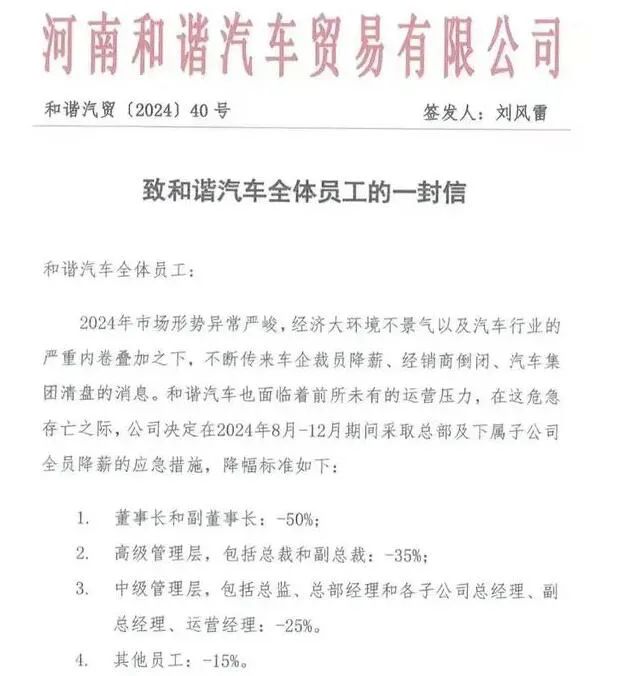

According to domestic media reports, Harmony Auto, a dealer group specializing in luxury and ultra-luxury cars, has been exposed to have all staff’s salaries reduced. According to the previously circulated “A Letter to All Employees of Harmony Auto”, the company decided to take emergency measures of salary reduction for all staff at the headquarters and its subsidiaries during the period from August to December 2024. Among them, the salaries of the chairman and vice-chairman were halved, the salaries of senior and middle-level management were reduced by 35% and 25% respectively, and the salaries of other employees were reduced by 15%.

In response to the above reports, Harmony Auto responded: “The salary reduction for all staff is a phased measure we have taken proactively to adapt to the general market environment, in order to increase our ability to withstand future risks. The company is confident that through various measures, this special stage will end as soon as possible.”

According to the official website of Harmony Auto, the company focuses on the main business of luxury and ultra-luxury car sales and lays out the comprehensive service industry of new energy vehicles. As of December 31, 2023, Harmony Auto has 80 globally authorized dealer outlets. Among them, it operates 14 luxury and ultra-luxury brands in mainland China, and its service network covers 40 cities in 17 provinces.

According to the annual financial report of Harmony Auto, the total sales volume in 2023 was 38,475 units, a year-on-year increase of 8.4%. Among them, 28,465 BMW (including MINI) vehicles were delivered throughout the year, a year-on-year increase of 6.4%, and 4,266 Lexus vehicles were delivered, a year-on-year increase of 10.1%. It is worth noting that although the sales volume increased, Harmony Auto was in a loss-making state. According to the annual report, Harmony Auto’s operating income in 2023 was 16.58 billion yuan, a year-on-year increase of 1.6%, and the net loss was 252 million yuan. Compared with a loss of 1.628 billion yuan in the same period, the loss was significantly reduced.

The decision of salary reduction for all staff of Harmony Auto reflects the severe challenges faced by the entire automotive industry. Currently, the days of most domestic auto dealers are tough. On the one hand, the overly high annual sales targets set by manufacturers have led to an imbalance between supply and demand in the automotive market. Multiple factors have triggered many large-scale and significant new car price cuts, causing consumers to hold onto their money and wait, suppressing the release of consumer demand. On the other hand, in the context of the growth of new energy vehicles and the contraction of the fuel vehicle market, some dealers are facing a situation of weakened product competitiveness, mainly manifested in serious upside-down new car prices, chaotic market prices, lack of continuity in manufacturer policies, forced bundling sales and inventory pressure, which have increased the operating pressure on dealers.

According to the survey results of the survival status of national auto dealers in the first half of 2024 released by the China Automobile Dealers Association, only 28.8% of dealers achieved their semi-annual sales targets in the first half of the year, while the proportion of dealers with a target completion rate of less than 70% still reached 33.3%. Among them, luxury/import brand dealers had a better completion of their targets, with 44.8% of dealers achieving their annual sales targets, while the target completion rates of joint venture brands and self-owned brands were 20.8% and 23.1% respectively. In addition to the failure of most dealers to achieve their annual sales targets, large-scale losses have also become the development status of dealers in the first half of the year, and the overall loss-making proportion of dealers is at a high level in recent years. According to the association’s survey, only 35.4% of dealers achieved profitability in the first half of the year, while the proportion of loss-making dealers reached 50.8%, and the proportion of dealers breaking even was 13.8%.

Currently, the automotive industry is facing difficult challenges. The government, associations, and enterprises are all working hard to boost the market recovery. Many measures to promote consumption, such as national tax cuts, local government subsidies, and manufacturer support, have had a strong stimulating effect on the demand and consumption side, accelerating the recovery of the automotive market. Industry insiders say that traditional auto dealers need to move from offline to online, comprehensively layout sales channels, and find new survival opportunities. Traditional auto dealers must actively transform and reform. Automobile marketing has shifted to direct-sale stores and business superstores, and it is necessary to establish cooperation with new energy vehicle brands in a timely manner.