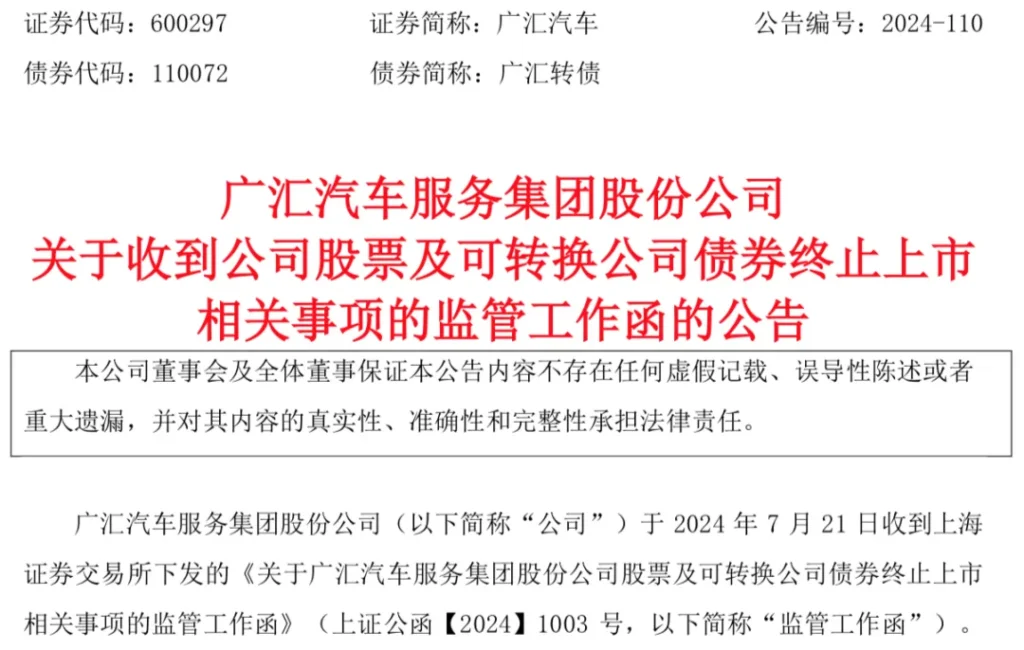

Grand China Auto released the latest announcement stating that Grand China Auto Service Group Co., Ltd. (hereinafter referred to as “Grand China Auto”) received the “Supervisory Work Letter on Matters Related to the Termination of Listing of Stocks and Convertible Corporate Bonds of Grand China Auto Service Group Co., Ltd.” (Shanghai Stock Exchange Official Letter [2024] No. 1003, hereinafter referred to as the “Supervisory Work Letter”) issued by the Shanghai Stock Exchange on July 21, 2024.

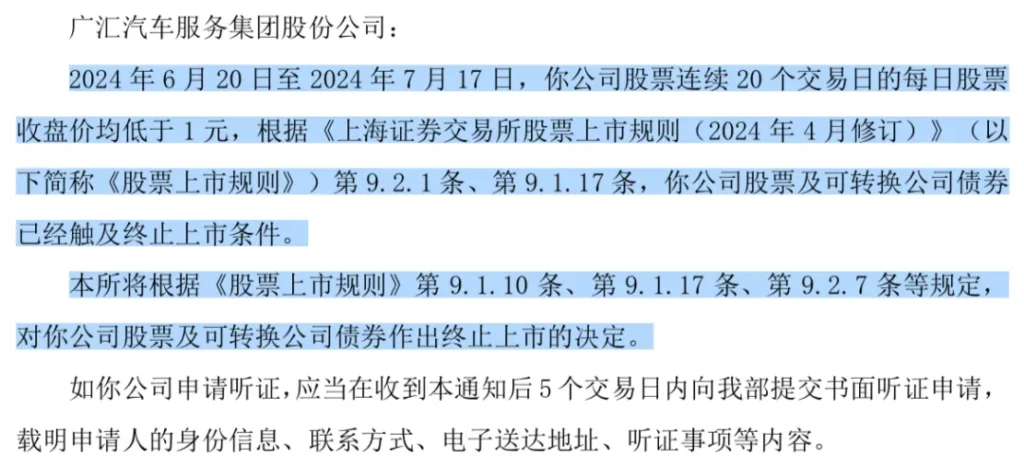

The announcement content shows that from June 20, 2024 to July 17, 2024, the daily closing price of Grand China Auto’s stocks for 20 consecutive trading days was all lower than 1 yuan. According to Article 9.1.17 and Article 9.2.1 of the “Stock Listing Rules of the Shanghai Stock Exchange (Revised in April 2024)” (hereinafter referred to as the “Stock Listing Rules”), the stocks and convertible corporate bonds of Grand China Auto have already touched the conditions for terminating listing.

The stocks and convertible corporate bonds of Grand China Auto have been suspended since the opening of trading on July 18, and the Listing review committee of the Shanghai Stock Exchange will review whether to terminate the listing of the company’s stocks and convertible corporate bonds after the expiration of the relevant period for Grand China Auto to propose a hearing, statement and defense or after the end of the hearing procedure within 15 trading days, and the Shanghai Stock Exchange will make the corresponding termination of listing decision according to the review opinion of the listing review committee.

As of July 19, Beijing time, the total market capitalization of Grand China Auto is 6.466 billion yuan.

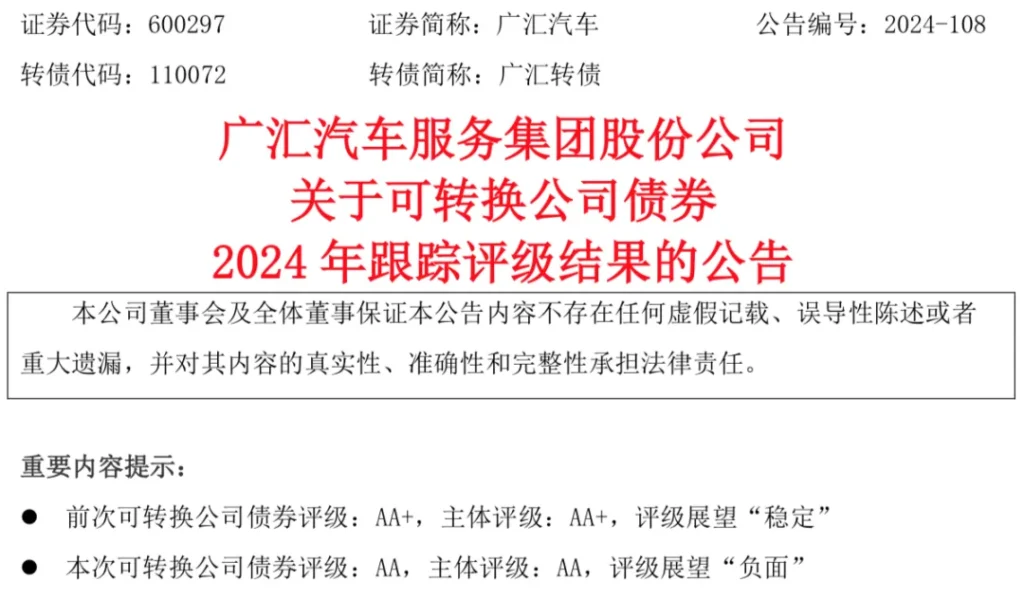

On July 19, Grand China Auto released the announcement on the 2024 follow-up rating results of convertible corporate bonds. The announcement shows that the previous convertible corporate bond rating: AA+, the main body rating: AA+, and the rating outlook is “stable”; this time the convertible corporate bond rating: AA, the main body rating: AA, and the rating outlook is “negative”.

At the verge of delisting, Grand China Auto transferred the control right to another company to try to save itself. On July 11, Grand China Auto released an announcement stating that the controlling shareholder, Grand China Group, has signed a framework agreement with Jinzheng Technology and intends to transfer through equity transfer. The agreement stipulates that after December 19, 2024, Grand China Group will transfer 24.5% of its shares in Grand China Auto to Jinzheng Technology. After the transaction is completed, the company’s control right will change. That is to say, Grand China Auto will welcome a new controlling shareholder. At that time, industry insiders believed that behind the proposed change of control right of Grand China Auto is the hope that after the new controlling shareholder joins, its share price can return to 1 yuan and eliminate the risk of “delisting due to face value”.

It is understood that Grand China Auto was established in 2006, and later successively acquired auto distribution companies in Anhui, Chongqing, Gansu, Hebei, Ningxia, Shandong and other places, and became the leading enterprise of national auto dealers in 2012. In June 2015, Grand China Auto successfully landed on the A-share market through the backdoor of Meiluo Pharmaceutical, and quickly acquired Baoxin Auto the following year, the latter being the largest dealer of BMW in China, and was later renamed Grand China Baoxin.

However, with the change of the overall market environment of the auto market and the intensification of competition, even as the leading enterprise of auto dealers, Grand China Auto also faces a decline in performance. Financial report data shows that from 2018 to 2020, Grand China Auto achieved net profits of 3.257 billion yuan, 2.601 billion yuan, and 1.516 billion yuan respectively, and the growth rates of net profits were -16.27%, -20.16%, and -41.72% respectively. Although the net profit increased slightly year-on-year in 2021, it suffered a huge loss in 2022, with a full-year loss of 2.669 billion yuan, a year-on-year decline of 265.92%. In 2023, Grand China Auto turned losses into profits, with an annual revenue of 137.998 billion yuan, but the net profit was only 392 million yuan, and its share price also fell below 2 yuan at the end of 2023.

After entering 2024, the operating conditions of Grand China Auto have not improved significantly. The latest financial report shows that in the first quarter of this year, Grand China Auto achieved revenue of 27.79 billion yuan, a year-on-year decline of 11.49%; and the net profit was 70.9405 million yuan, a year-on-year decline of 86.61%. It is understood that as of the end of the first quarter of this year, the asset-liability ratio of Grand China Auto reached 61.98%.

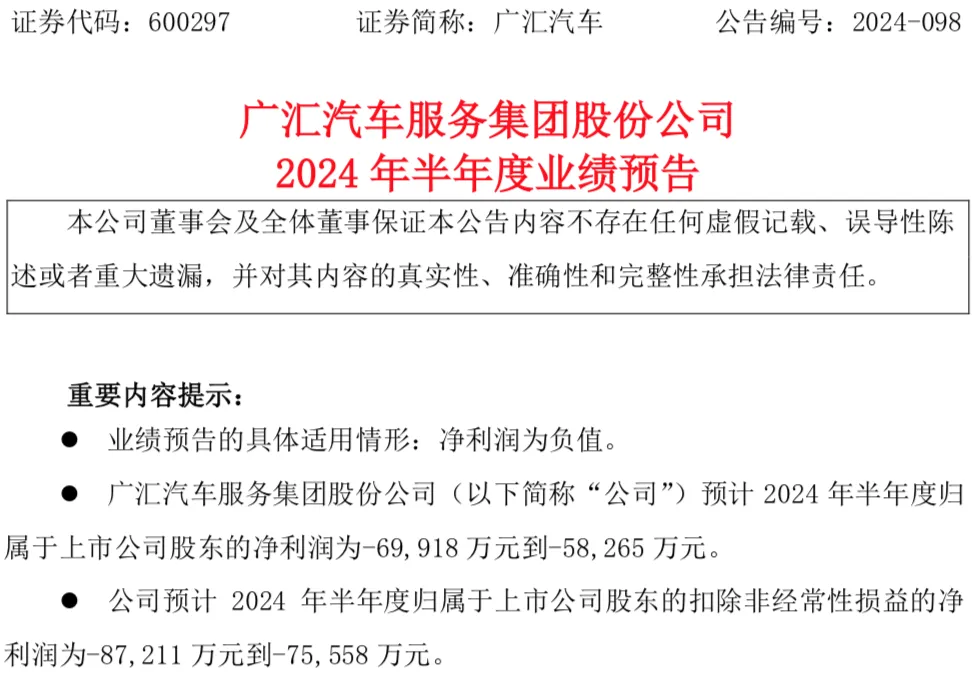

On July 13, Grand China Auto released the semi-annual performance forecast for 2024, stating that the expected net profit attributable to the parent company in the first half of the year is -583 million yuan to -699 million yuan.

As one of the largest auto dealer groups in China, in May this year, the China Auto Dealers Conference released the “2024 Top 100 Dealer Groups in the Auto Circulation Industry in China”, and Grand China Auto ranked at the forefront of the list with a revenue scale of 137.998 billion yuan and ranked first among the top 100 dealer groups with a sales volume of 713,467 vehicles. This is the 13th consecutive year that Grand China Auto has been on the “Top 100 Dealer Groups in the Auto Circulation Industry in China” list.

Nowadays, it is really lamentable that Grand China Auto has come to the difficult situation today, but the dilemma faced by Grand China Auto is not an isolated case, but only a microcosm of the development of many dealer industries. Especially today, the domestic auto market is highly involute, the profit margin of dealers has been further compressed, and the “price war” has had a profound impact on the auto distribution industry, and the days of most auto dealers are not easy.

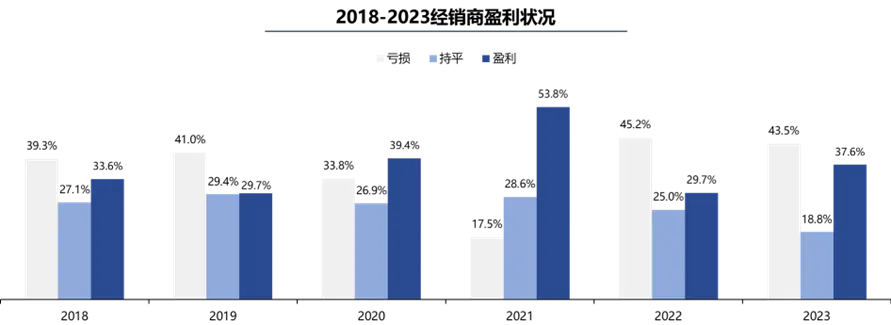

According to the “Survey Report on the Survival Status of National Auto Dealers in 2023” released by the China Automobile Dealers Association, in 2023, only 27.3% of the dealers completed the annual sales target. In addition, the loss ratio of dealers in 2023 was 43.5%, and only 37.6% of the dealers achieved profitability.

In the first half of 2024, the completion situation of the dealer’s sales task also showed obvious differentiation. Among them, 18.4% of the dealers completed the task, 34.8% of the dealers completed more than 80% of the task, and 13.5% of the dealers completed less than 50%. In this regard, the China Automobile Dealers Association said that currently, the pessimistic sentiment of dealers is spreading, and they are relatively cautious about the auto market expectations in the second half of the year. It is recommended that dealers should rationally estimate the actual market demand according to the actual situation.

With the increasingly fierce stock competition situation and the continuous price war blow, the auto dealer industry is under collective pressure. In this context, how auto dealers seek change, or how to adapt to the changes of the times, is worthy of thinking.