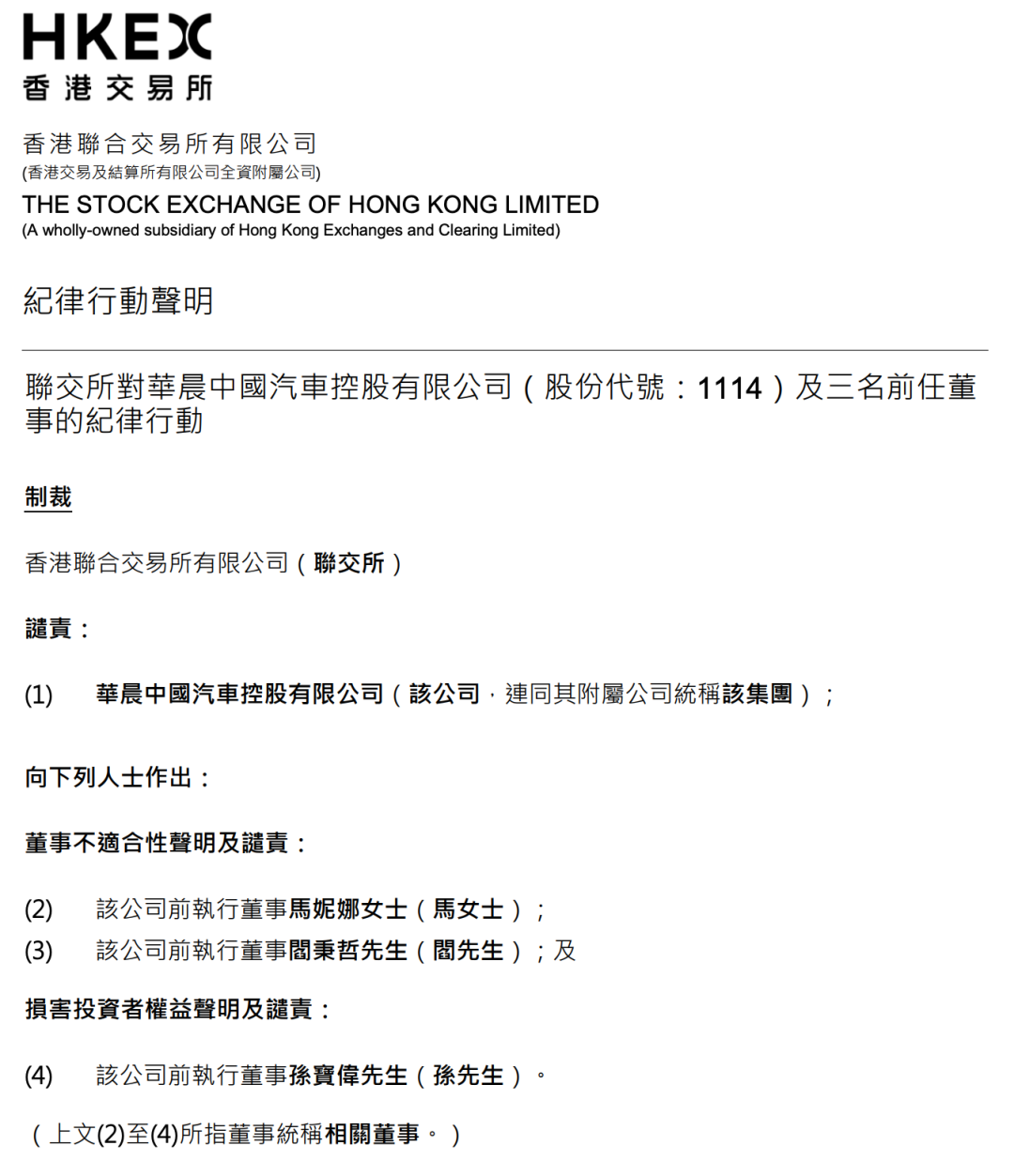

On August 27th, the Hong Kong Stock Exchange took disciplinary actions against Brilliance China Automotive Holdings Limited and three former directors for their misconduct. In this disciplinary action, the Hong Kong Stock Exchange publicly censured Ma Nina, the former executive director of Brilliance China, Yan Bingzhe, the former executive director, and Sun Baowei, the former executive director. The Hong Kong Stock Exchange stated that neither Ma Nina nor Yan Bingzhe are suitable for holding positions as directors or senior management of the company or any of its subsidiaries. If Sun Baowei remains a director on the company’s board, it would harm the interests of investors. The Hong Kong Stock Exchange’s investigation found that during the audit of the 2020 annual results, the auditor discovered that the wholly-owned subsidiary Shenyang Jinbei Automobile Industry Holdings Co., Ltd. (hereinafter referred to as “Jinbei Auto Holdings”) provided multiple guarantees for the then controlling shareholder Brilliance Automotive Group Holdings Co., Ltd. (hereinafter referred to as “Brilliance Holdings”), and legal proceedings for the enforcement of the guarantees against Jinbei Auto Holdings had already begun at that time. Due to the discovery of the above guarantees, the company delayed the release of its 2020 annual results and launched two independent investigations. The independent investigation found that several wholly-owned subsidiaries (including Jinbei Auto Holdings) provided financial assistance of over 53.4 billion yuan to Brilliance Group and other entities for their interests under the influence of Brilliance from 2019 to 2021. The financial assistance included guarantees, deposit pledges, and fund transactions, but did not bring any obvious commercial benefits to the company. The relevant directors held senior management positions in Brilliance. Despite the obvious conflict of interest, they were involved in the financial assistance provided by the company to Brilliance, and none of them reported the relevant financial assistance to the board. Ma Nina’s position in Brilliance was the director of the capital operation department and the deputy chief accountant, while her position in Jinbei Auto Holdings was the executive director and a director of Shenyang Xingyuandong Auto Parts Co., Ltd. (hereinafter referred to as “Xingyuandong”), which was the sole shareholder of Jinbei Auto Holdings at that time. Ma Nina was a major participant in all financial assistance. She was aware of and involved in the arrangements of guarantees and deposit pledges, arranged for the director of the capital operation department of Brilliance for the relevant transactions, and allowed the relevant fund transactions. Yan Bingzhe’s position in Brilliance was the chairman and legal representative, and he served as the executive director and chief executive officer of Jinbei Auto Holdings. Yan Bingzhe was involved in some financial assistance, signed the board resolution of Brilliance, resolving that Brilliance would apply for credit lines and loan extensions from the bank through the joint guarantees of Jinbei Auto Holdings and another subsidiary of Brilliance. He was aware of the guarantees and the legal proceedings for the enforcement of the guarantees but did not report to the board. Sun Baowei was the director of the capital operation department of Brilliance, and also served as the executive director of Jinbei Auto Holdings and a director of Xingyuandong. Sun Baowei was involved in some financial assistance. As a director of Xingyuandong, he approved some fund transactions made to Dalian Huaxia Group but did not report to the board. He was aware of the guarantees and the legal proceedings for the enforcement of the guarantees but did not report to the board. Brilliance Automotive Group Holdings Co., Ltd. was established in September 2002 with a registered capital of 800 million yuan. Brilliance Group is a large vehicle manufacturing enterprise controlled by the State-owned Assets Supervision and Administration Commission of Liaoning Province. It directly or indirectly controls or holds shares in four listed companies and established the joint venture Brilliance BMW with BMW through its listed company Brilliance China. On November 20, 2020, the Shenyang Intermediate People’s Court ruled to accept the application of the creditor of Brilliance Group for the reorganization of Brilliance Automotive Group, and Brilliance Automotive Group officially entered the bankruptcy reorganization process. Previously, Brilliance Group had three self-owned brands, namely Zhonghua, Jinbei, and Huasong, and two joint venture brands, Brilliance BMW and Brilliance Renault. But by 2024, only Brilliance BMW was struggling to support the group, and the shareholding ratio decreased from 50% previously to 25%. The financial report shows that from 2019 to 2023, Brilliance China achieved operating incomes of 3.862 billion yuan, 3.123 billion yuan, 2.142 billion yuan, 1.131 billion yuan, and 1.121 billion yuan respectively, and net profits of 6.763 billion yuan, 0.11 billion yuan, 11.961 billion yuan, 7.147 billion yuan, and 7.735 billion yuan respectively. Previously, Brilliance China released its interim results for 2024. During the reporting period, it achieved an income of 518 million yuan, a year-on-year increase of 2.0%; the net profit was 1.473 billion yuan, a year-on-year decline of 60.65%.

Involving 53.4 billion in subsidies! A certain automaker has been subject to disciplinary actions.