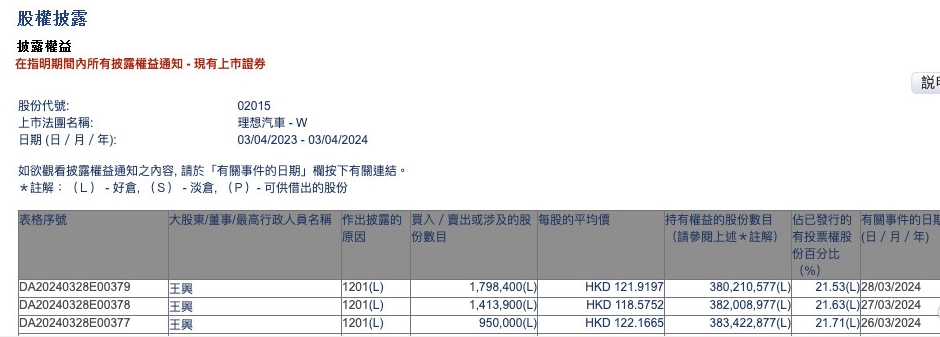

Recently, according to the documents disclosed by the Hong Kong Stock Exchange, LI Auto Executive Director and Meituan co-founder Wang Xing reduced his holdings of 950,000, 1,413,900, and 1,798,400 ordinary shares of LI Auto for three consecutive days from March 26 to 28, with a total reduction of 4,162,300 shares of LI Auto, involving nearly HKD 503 million.

After the reduction, Wang Xing’s shareholding ratio in LI Auto decreased from 21.76% to 21.53%. In response to Wang Xing’s reduction, LI Auto responded that this transaction of shares is a personal act and the transaction only accounts for a small portion of Wang Xing’s total shareholding, and does not involve the shareholding of Meituan.

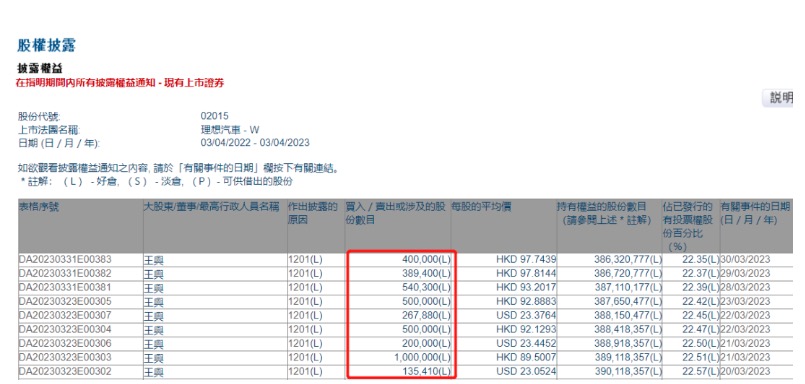

It is worth noting that this is not the first time that Wang Xing has reduced his holdings of LI Auto shares. Last year in March, Wang Xing had sold LI Auto shares 9 times in a row, reducing a total of about 3.9329 million shares and cashing out about HKD 420 million.

In September last year, Wang Xing once again reduced his holdings of LI Auto’s Hong Kong shares four times, reducing a total of 1.9479 million shares and cashing out HKD 310 million. After this reduction, Wang Xing holds 384 million shares of LI Auto and the shareholding ratio drops from 21.89% to 21.79%. At that time, Wang Xing’s move also attracted the attention of people inside and outside the industry. At that time, LI Auto’s response was also to say that this transaction of shares was a personal act of Wang Xing.

Information shows that: Wang Xing is the founder and CEO of Meituan, the actual controller of Meituan, and has invested in LI Auto many times. In July 2019, Wang Xing served as a non-executive director of LI Auto. In August 2019, LI Auto announced the completion of a C-round financing of $530 million. This C-round financing was led by Meituan founder Wang Xing, among which Wang Xing personally invested $285 million, and Longzhu Capital under Meituan invested $15 million.

In 2020, LI Auto announced a D-round financing of $550 million, which was also led by Wang Xing. Among them, $500 million came from Meituan’s strategic investment department. LI Auto went public in the US, and Meituan invested $300 million to subscribe for LI Auto shares, and Wang Xing subscribed for $30 million. According to incomplete statistics, Wang Xing and Meituan have invested a total of $1.15 billion in LI Auto, and are the largest external shareholder of LI Auto.

For the reduction of LI Auto shares by major shareholder Wang Xing, some industry insiders said that this move may be to adjust the investment strategy and look for new investment opportunities. In addition, some business insiders pointed out that it may be due to the current new car sales of LI Auto not meeting expectations, and the measures of uncertainty about the future development prospects of LI Auto.

It is well known that since the launch of LI Auto’s blockbuster model MEGA on March 1, LI Auto has not had an easy time. In addition to being suppressed by the sales of AITO, the model MEGA, which LI Auto has high hopes for, has performed less than expected after its launch. To this end, LI Auto also announced the lowering of annual sales targets in March, lowering the vehicle delivery volume in the first quarter by 24,000 to 25,000 vehicles, and the expected delivery volume in the first quarter is 76,000 to 78,000 vehicles.

In addition, there are also rumors in the market that LI Auto’s target of 800,000 vehicles set for this year may be lowered by 160,000 to 240,000 vehicles, and the adjusted annual target will be 560,000 to 640,000 vehicles. Although the official has not responded to this news, at present, LI Auto’s situation is not optimistic. Since the beginning of 2024, LI Auto’s sales champion position has been gradually replaced by AITO. Data shows that the cumulative sales of LI Auto in the first quarter was 80,400 vehicles, and the sales of AITO in the first quarter was 85,800 vehicles.

Furthermore, with the entry of Xiaomi Auto, at this stage, many auto companies have also started to fight a price war to seize the market, and the subsequent competitive pressure of LI Auto will also increase. Against this background, Wang Xing’s act of reducing his holdings as a major shareholder of LI Auto will also have a certain impact on the secondary market of LI Auto.