Today, NIO announced that Feng Wei, the chief financial officer, resigned, and the subsequent position will be taken over by Qu Yu, which will take effect from July 5, 2024. In the announcement, the official affirmed Feng Wei’s contribution to NIO, and pointed out that Feng Wei resigned due to personal and family reasons.

In addition, the announcement also gives a brief introduction to the new chief financial officer, Qu Yu. The official said that Qu Yu joined NIO in October 2016 and is mainly responsible for the company’s financial and reporting business, showing strong professional skills and leadership abilities in these businesses. Before joining NIO, she worked at PwC for ten years, and later served as several financial leadership positions in leading multinational companies such as Lear and Johnson Controls.

It is worth mentioning that this is not the first time that the chief financial officer of NIO has resigned. In October 2019, NIO was facing life and death and urgently needed financing to survive. At that time, its then chief financial officer, Xie Dongying, resigned for personal reasons. At that time, the official also announced in the announcement that it was due to personal reasons for resignation. It is looking for a successor to Xie Dongying and hopes to fill this position as soon as possible and announce it to the outside world at the appropriate time. At that time, affected by this news, NIO’s stock price plunged to $1.48 / share on the same day, on the verge of delisting.

Subsequently, the position was taken over by Feng Wei. Data shows that Feng Wei has rich industry experience and has worked for ZF Group for many years, and then served as an industry analyst at Everbright Securities Co., Ltd., and a managing director of the research department of CICC. In November 2019, he served as NIO’s chief financial officer, that is, he took over the position in the month after Xie Dongying’s departure.

In fact, the retention or departure of many core senior executives of new car-making forces often leads to many speculations, and most of the speculations are closely related to the operating conditions of the enterprise.

As we all know, since this year, although NIO’s sales in the market have increased, the losses are still increasing. Relevant data shows that NIO’s latest sales in June were 21,209 vehicles, a year-on-year increase of 98.1%, a month-on-month increase of 3.2%, and the cumulative sales from January to June were 87,426 vehicles. Looking at the sales growth rate, NIO still has not escaped the predicament of losing money for every car sold.

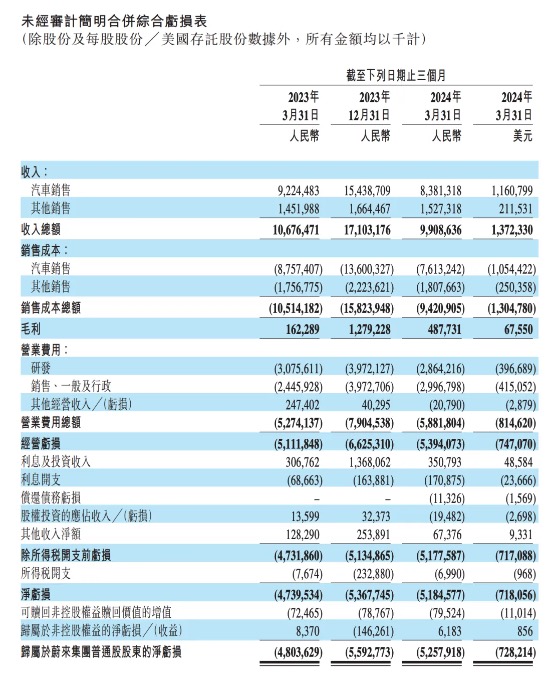

According to the latest financial report released by the official, NIO’s total revenue in the first quarter of this year was 9.909 billion yuan, a year-on-year decrease of 7.2%. Among them, the auto sales were 8.381 billion yuan, a year-on-year decrease of 9.1%; the quarterly net loss was 5.185 billion yuan, a year-on-year increase of 9.4%; in terms of gross profit margin, the gross profit margin in the first quarter was 4.9%, compared with 1.5% in the same period, and the auto gross profit margin was 9.2%, compared with 5.1% in the same period. NIO CEO Li Bin once revealed that the vehicle gross profit margin will return to double digits in the second quarter and continue to improve in the third and fourth quarters.

At this stage, in order to get out of the situation of losses, NIO also launched the Ledu brand this year. The new brand is positioned in the 200,000-300,000 yuan household market. For NIO, the Ledu car may take on the burden of increasing NIO’s sales. It is not yet known whether the Ledu car can allow NIO to get out of the predicament of losses as soon as possible, which still needs to be verified over time.

Returning to the matter of Feng Wei’s departure, as a core figure of NIO, he resigned shortly after the launch of the new brand, which inevitably leads to outside concerns about the operation of NIO.