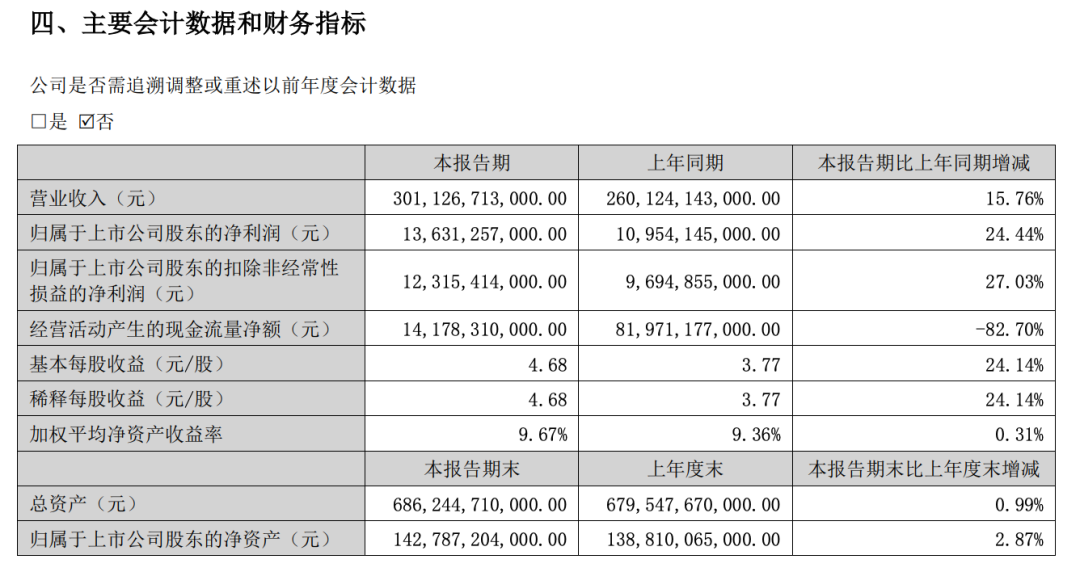

BYD submits the “report card” of half-year performance and becomes the most profitable automaker in China. On August 28, BYD released the interim performance report for 2024. The report shows that in the first half of the year, BYD’s operating income was 301.127 billion yuan, an increase of 15.76% year-on-year; the net profit was 13.631 billion yuan, an increase of 24.44% year-on-year; and the non-recurring net profit was 12.315 billion yuan, an increase of 27.03% year-on-year. On the same day, SAIC Motor released the interim performance report for 2024, showing that during the reporting period, SAIC Motor achieved an operating income of 284.7 billion yuan, a year-on-year decline of 12.82%; the net profit was 6.627 billion yuan, a year-on-year decline of 6.45%; and the non-recurring net profit was 1.020 billion yuan, a year-on-year decline of 82.00%. The market performances of SAIC Motor and BYD present a huge contrast. With one rising and the other falling, SAIC Motor’s position in the domestic market has been seriously threatened. In contrast, BYD’s net profit is more than double that of SAIC Motor. During the reporting period, BYD’s cumulative vehicle sales were 1.6130 million units, an increase of 28.46% year-on-year, while SAIC Motor’s were 1.8270 million units, a year-on-year decline of 11.81%. Among them, the sales of new energy vehicles were 461,000 units, an increase of 23.90% year-on-year. Although SAIC Motor’s sales volume was nearly 200,000 units higher than BYD’s, due to large-scale price reduction promotions of joint venture brands, SAIC Motor’s overall sales volume did not increase significantly but declined instead, thereby affecting the group’s profit performance. It is worth noting that BYD’s vehicle sales have exceeded SAIC Motor’s for two consecutive months. In July, SAIC Motor’s wholesale sales volume was 251,500 units, a year-on-year decline of 37.16%, while BYD’s was 342,400 units, a year-on-year increase of 30.60%. This was the second consecutive time BYD exceeded SAIC Motor within the year. In June, SAIC Motor’s wholesale sales volume was 300,500 units, a year-on-year decline of 25.92%, while BYD’s was 341,700 units, a year-on-year increase of 35.02%. As of the end of July, BYD’s cumulative sales volume was 1.9554 million units, an increase of 28.83% year-on-year, while SAIC Motor’s cumulative sales volume was 2.0784 million units, a year-on-year decline of 15.92%. The sales gap between SAIC Motor and BYD was only 123,000 units. With the decline of joint venture brands, SAIC Motor’s decline is continuously expanding. According to the current market performance, BYD only needs two months to surpass SAIC Motor and become the largest automaker in China. Therefore, the counterattack of joint venture brands will be the top priority for SAIC Motor in the next five months, especially SAIC GM. In order to regain the market, SAIC Motor has carried out a series of personnel changes. In August, SAIC Motor completed the largest-scale senior management adjustment in 2024. From SAIC Motor to SAIC Volkswagen, SAIC GM, SAIC Passenger Vehicle, and SAIC-GM-Wuling, as many as 15 senior executives were involved in the adjustment, almost completing a comprehensive change of leadership from the group to each subsidiary. Whether it is the frequency of changes or the number of people and positions involved, it is unique in the current automotive industry. It is undeniable that SAIC Motor has entered the “deep water zone” of transformation. The sales volume of joint venture brands is low, and the EU has erected a “tariff wall” for Chinese electric vehicles. How to accelerate the rise of independent brands and reduce the operating pressure in the overseas market are still issues to be solved by the new management. It is expected that such a large-scale adjustment of the senior management structure can play a positive role to a certain extent in its innovative transformation and return to the right track of development. As for BYD, after the Spring Festival of the Year of the Dragon, it shouted the slogan of “electricity is cheaper than oil”, launched several honor versions of models, reduced the prices of Qin PLUS and Destroyer 05 to 79,800 yuan, further seizing the traditional fuel vehicle market. At the same time, BYD launched several new models, including Qin L, Song L, Seal 06, etc. It is worth noting that one day before the release of the interim report, BYD’s Fangchengbao brand announced a cooperation with Huawei, and Leopard 8 will be equipped with Huawei’s Kunlun ADS3.0, becoming the first model of BYD equipped with Huawei Kunlun intelligent driving. Since this year, the domestic automotive market has accelerated its transformation towards electrification and intelligence. For BYD, with the breakthrough in sales volume and the development towards high-end, intelligence will be a key link in the second half to maintain its competitive advantage. As for SAIC Motor, its position in the domestic market has begun to shake. It is no longer the most profitable automaker in China, and the title of the number one automaker in China may also be taken away. Fundamentally, the transformation of automakers requires new leaders to change the relatively outdated internal organizational structure and management system in the past, and build a new team to lead the company to move forward better. However, it is not easy for a big company like SAIC Motor, which has three joint venture brands and five independent brands, to eliminate the accumulated problems.

The most profitable automaker! BYD earns 70 million yuan a day.