According to media reports, Toyota Motor is in discussions with Shanghai on the possibility of building a wholly-owned factory, expecting to receive similar treatment to Tesla, including tax reductions and land subsidies. For this move, foreign media believe that Toyota Motor may use this factory to produce high-end brand Lexus electric vehicles. As of the time of submission, Toyota Motor has not responded for the time being.

Toyota is the largest automotive manufacturer in the world, with global sales of 11.233 million vehicles throughout the year 2023, a year-on-year increase of 7.2%. Among them, Toyota’s vehicle sales were 10.307 million, a year-on-year increase of 7.7%, and it has consecutive for four years surpassed the Volkswagen Automotive Group to be the largest automotive manufacturer in the world. However, after entering 2024, along with the rapid rise of independent brands, like other Japanese automotive manufacturers, Toyota’s share in China has declined.

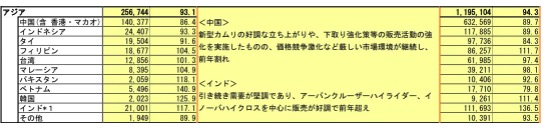

According to Toyota’s global data, from January to May 2024, Toyota’s vehicle sales in the Chinese market (including Hong Kong) were 632,569 vehicles, a year-on-year decline of 10.3%. Among them, the sales in May were 140,377 vehicles, a year-on-year decline of 13.6%. In the Chinese market, Toyota has two joint venture companies in China, namely Guangqi Toyota and FAW Toyota. Among them, the sales of Guangqi Toyota declined by 14.8% year-on-year to 292,377 vehicles, which caused Guangqi Toyota’s ranking in China’s top ten automotive brands to slip to seventh, with a market share of 3.6%. FAW Toyota has fallen out of the top ten lists many times.

As for Lexus, it is no longer as popular in the Chinese market as before. On the one hand, the change in the purchasing preference of the domestic market, with the rapidly growing new energy vehicle brands represented by independent brands and new forces, has to a certain extent squeezed the market share of some luxury brands and imported cars. On the other hand, consumers’ recognition of the brand image has improved, and the high-end image of imported brands has begun to weaken. The data shows that from January to May 2024, the sales of the Lexus brand in China were 69,147 vehicles, a year-on-year increase of 28%. Previously, Lexus introduced a pure electric mid-sized SUV – RZ in the Chinese market, with a price range of 355,900-379,900 yuan. However, compared to fuel vehicles, the sales of RZ are quite ordinary, and the cumulative sales in the first five months are only 445 vehicles.

As for the possibility of Lexus being produced in China, in fact, it has not been reported for the first time. Almost every two to three years, there are related reports. In the past, the background was that the tariff on foreign imported cars was gradually reduced, Lexus imported car sales continued to grow year after year, coupled with the very short transportation distance from Japan to China, Lexus really did not have the necessity of being produced in China. However, from the current market point of view, the days of Toyota and Lexus in the Chinese market are not as good as before. As Toyota’s core luxury brand, Lexus must take the lead in leading the electrification transformation. In addition, both electrification and intelligence are the future development directions of automobiles, and Chinese automobiles also lead the global market because of this advantage.

According to the plan, Lexus will achieve 100% electrification by 2035. In Toyota’s latest plan, the next-generation BEV (pure electric vehicle) products (that is, the new generation of BEV products) developed by the BEV Factory will be put on the market in 2026, and the new products will be the first to be put on the market from the Lexus brand.

In addition, in 2026, Toyota is expected to introduce 10 new BEV models, with an annual sales volume of 1.5 million vehicles. Among these 1.5 million electric vehicle sales targets, a considerable portion also needs to be completed in the Chinese market. Toyota Motor Corporation’s CTO (Chief Technology Officer), Deputy President, and Executive Officer Nakajima Yuuki once stated, “The global status of China’s market electrification is beyond doubt. Up to 2026 in the BEV plan, the new models introduced in China must definitely account for the majority. So the importance of the Chinese market in our hearts will not change, and in the future, Toyota will firmly push forward the development of electrified products in the Chinese market.”

Toyota Motors is trying its best to change its gradually lagging behind trend in the Chinese market. Cooperating with Chinese companies such as BYD to develop new energy vehicles is one of the fastest ways for it to sit at the table. In May this year, there were media reports that Toyota plans to introduce several plug-in hybrid vehicles based on BYD’s DM-i technology in the next 2-3 years, but it was finally refuted by Toyota China. On June 28, Guangqi Toyota announced at the Technology Day that it will cooperate with the Chinese start-up company Momenta to use end-to-end technology to build an autonomous driving decision system, which will be first applied to the Toyota bZ3X pure electric vehicle.